You Bet: Hollywood’s New Money Is Dirty — and Hard to Resist

Prediction-market cash is flooding Hollywood; California’s long-awaited production money finally arrives

I cover TV and host Ankler Agenda. I wrote about our high-powered Ankler Invitational tennis tournament, reported on film schools’ scramble to address industry disruption and dug into agents’ concerns about a Netflix-Warner Bros. deal. I’m elaine@theankler.com

In today’s newsletter, I’m looking at some of the new money flowing into Hollywood — and what it says about where the industry is right now.

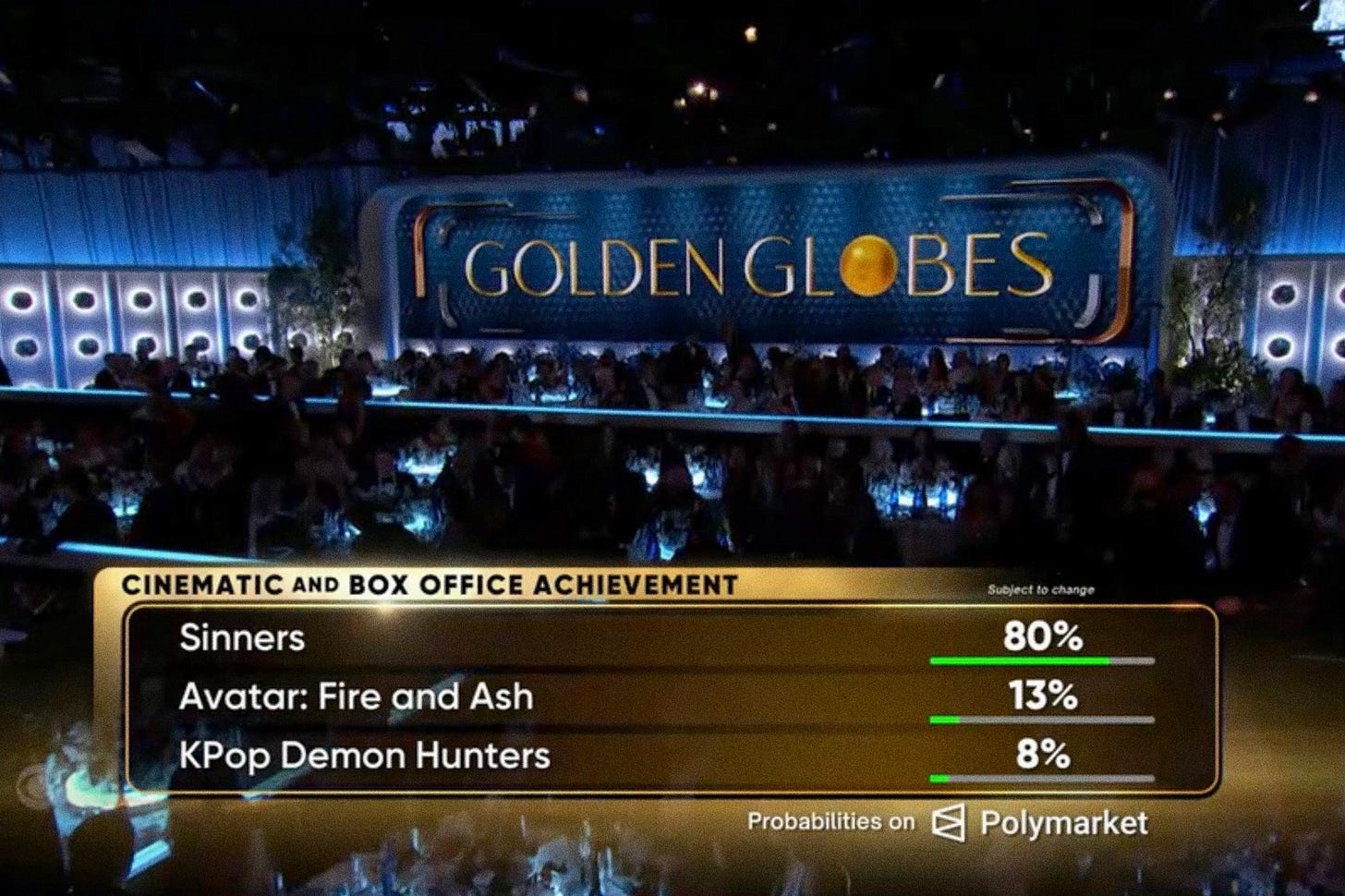

First up: Polymarket, the crypto-powered prediction market that made a loud (and baffling) debut at the Golden Globes — and I have fresh intel below about how the company is now actively seeking ways to push deeper into entertainment, based on conversations with streaming executives, producers and agents over the past week.

Betting and prediction platforms increasingly see Hollywood not just as content, but as an under-monetized arena for attention, sponsorship and speculative capital. (Regarding its deal with the Globes, where Polymarket odds for each award were splashed onscreen, I’ve heard estimates as low as $10 million and as high as $100 million — fill me in if you know at elaine@theankler.com).

These platforms are finding willing takers of their money, despite a pretty powerful ick factor associated with the “degenerate economy” (the catch-all term for crypto, gambling and vice stocks). Across the industry, creatives and dealmakers are hunting for new partners and unconventional ways to offset the financial risk of making TV — even if the ethical and practical complications are still very much unresolved. Fellow federally regulated prediction site Kalshi, for instance, has enmeshed itself within CNN and CNBC; DraftKings is the official sportsbook and odds provider of ESPN.

It’s all very big business: Nearly $12 billion was traded on Kalshi and Polymarket in December, according to data from the investment bank Piper Sandler reported in the New York Times. That marked a 400 percent increase from a year earlier.

Then also today, I have news at the other end of the spectrum from a far more traditional source of funding: California’s newly expanded $750 million film and TV tax credit. After years of grim FilmLA reports and shrinking local production, early signs suggest the incentive may finally be starting to move the needle — though not fast enough for everyone still trying to survive on the ground.

So this is my look at two very different financing pots shaping Hollywood’s future: one flush with cash and controversy, and one carrying the long-awaited hope of a local production rebound.

I’ll reveal:

Polymarket’s Hollywood overtures, which producers are seeking betting partners and why entertainment is harder to gamify than live sports

How prediction markets could quietly influence creative and business decisions long before projects reach audiences

Highlights from my chat with FilmLA CEO Denise Gutches about the positive impact from the production credit and which shows are shooting in L.A.

Insights from the vantage point of Pam Elyea, cofounder of iconic North Hollywood prop house History for Hire.

Elyea’s secrets for surviving the local production downturn amid rising costs, and the industry “game changer” she’s fighting for

The Bet on ‘Gamifying’ Film and TV

When the Globes splashed the Polymarket odds onscreen for best original song in a motion picture, it surprised no one to see KPop Demon Hunters song “Golden” with an 87 percent chance of winning vs. compositions from Sinners and Wicked: For Good.

What might be surprising is what I’ve since learned about Polymarket’s stealth inroads in town: