Shonda v. Ryan: Who's Winning at Netflix?

ESG analyzes head-to-head the two richest deals in TV and their return on investment

To subscribe to The Ankler, and read more stories like these, please join our community here.

If any two moves symbolized the impending doom of traditional studios, it had to be Netflix signing two huge showrunner megadeals in 2017 and 2018. The streaming wars were new, Netflix had all the momentum, and they proved it by wresting away two of the biggest showrunners in TV from Disney (and soon-to-be-owned-by-Disney Fox) for eye-popping amounts of money. This headlines said it all:

It was $300 million dollars for Ryan Murphy, of American Horror Story and Glee fame! And $100 million for the Shonda Rhimes of Grey’s Anatomy and Shondaland fame! Who cares that, as a company, Netflix would end up losing $3 billion that year in 2018; they sure could spend!

Old Hollywood was doomed. Dead! They couldn’t compete with this type of financial firepower.

Four years later — wait, four years!? —we now can check back in on these two mega-deals. In the intervening time, the streaming ratings era began and we know more now about what works (and doesn’t) than ever before. So let’s ask — and answer — a simple question: who won this showdown? And what does it mean going forward?

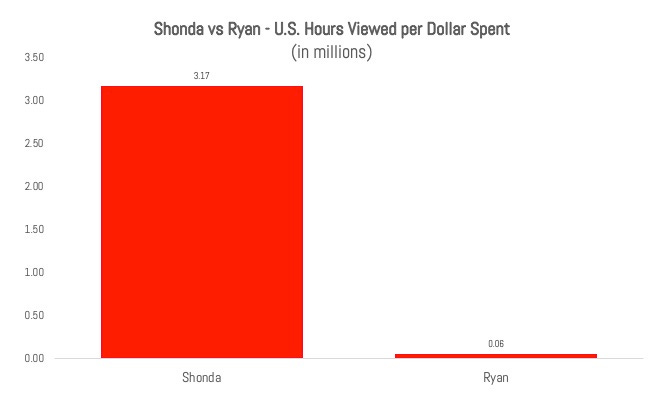

Spoiler: Shonda Wins. And It Ain’t Even Close

Here’s the one chart you need to see in its gruesome glory

Rhimes has produced two shows for Netflix: one she executive produced (Bridgerton) and one she show-ran (Inventing Anna). Both were big, big hits. (We don’t have Nielsen data for Bridgerton season two, which debuted on March 25 yet. But according to Netflix’s global data, it’s their biggest hit through three days.)

Here’s that same look by week:

In slight fairness, some of Ryan Murphy’s shows debuted before Netflix expanded their streaming ratings to 30 data points per week. And this is a U.S.-only look, not global viewership.

Still, in a battle this lopsided, those caveats don’t matter. Shonda’s shows are more broadly appealing than Ryan’s, so if his shows don’t perform in the U.S., they’re not going to have a long life globally. (I’d love to use Netflix’s own data for comparison here, but it only goes back to July of 2021, so we don’t have enough.)

You ready for the real gut punch for Netflix? When determining ROI (return on investment), results are only half the equation. The other half is the cost. It doesn’t just matter that the shows are popular, one must also ask how much it cost to get those shows in the first place.

Let’s call it “hours viewed per overall dollar spent in the U.S.”. Meaning how much viewing each overall deal delivered for the cost of the overall deals. You ready?

In other words, not only did Rhimes generate a ton more viewership than Murphy, up until she renegotiated her deal last summer, she did it at one-third the cost! That’s a great deal for Netflix.

(For the record, some outlets noted that Murphy’s $300 billion dollar price tag potentially included incentives. Given that’s the number they splashed on headlines in The Hollywood Reporter, it’s the number I’m going with.)

Hey ESG! You Forgot Ratched! And The Politician!

No, I didn’t.

Those two shows — Ratched, which premiered in September of 2020 and The Politician, which premiered in June of 2020 —were both shows that existed before Murphy’s overall deal. Specifically, he created them for 20th Century Television, which sold them to Netflix. Here’s the Wiki page for Ratched:

Still, if you want to see how the number would have changed with those extra data points, including some other films Murphy executive produced as well, here you go:

Honestly, it doesn’t really change the analysis. Ratched did fine, but didn’t come close to Bridgerton. Meanwhile, you can see that when it comes to “hit rate”, Shonda is two for two, whereas Ryan is one for eight.

What Does This Mean for Netflix?

Well, Netflix probably knows these numbers aren’t very good. There’s no complicated formula or analysis they can run that turns low viewership numbers into gold. Any metric starts with hours viewed. And Shonda has much, much more viewership.

So the question is: does Netflix extend his lucrative deal?

They already reupped Shonda Rhimes’ deal last year. (Smart!) Meanwhile, Netflix let go of the executive who signed these deals initially, Cindy Holland, and centralized television under Bela Bajaria. She immediately streamlined the overall deals, leading folks to speculate if future mega-deals would be harder to come by. (The quotes from new head of overalls, Peter Friedlander, in this THR piece aren’t exactly gushing.) After all, since the stock tanked, Netflix has reportedly told employees to keep costs in check.

Though, for the record, Holland probably shouldn’t be the fall person for Murphy deal’s big price tag. Here’s The Hollywood Reporter describing Murphy’s wooing process at Netflix in 2018:

But coming in out of the rain, he was whisked to a theater on the top floor of the 14-story building, where content chief Ted Sarandos along with his heads of marketing, social media, scripted and young adults programming awaited. “We want you to know what you mean to us,” Sarandos told Murphy, whose catalog of hits streams on the platform. Over the next two hours, the group dazzled him with highly confidential data on the viewing habits of its 117 million global subscribers and lit up a world map on which the countries where his programs were most popular shined brightest.

Huh. Whoever that Sarandos guy is, he seems pretty responsible for this deal!

What Comes Next?

Well, I’ve been pretty negative on Netflix, since they basically paid three-tenths of a billion dollars for a guy who isn’t making them hit shows.

(One caveat: Richard Rushfield told me there’s great buzz for Ryan Murphy’s upcoming Jeffrey Dahmer show, which feels a bit more like a return to form — genre — for Murphy. So he could rebound somewhat, though likely can’t catch Shonda. Her lead is too big.)

But we know that Netflix has almost admitted their mistake without admitting it. But does anyone else in Hollywood get this? Here’s a quote from Disney TV’s chairman of entertainment, Dana Walden, and Murphy BFF:

I don’t think there’s any point in being coy about the fact that my dream would be for Ryan to come back to work with us at our studio…I hope that’s an opportunity at one point, and that’s said with no disrespect to our competition. I think they were brilliant to pick him.

Well, that’s Hollywood for you! Back in 2018, it was a big blow for Disney (and soon to be Disney-owned Fox) to lose not one, but TWO showrunners to Netflix. But of the two, is Walden hinting she’d take back the one?

Maybe Netflix will win this war after all.

If you enjoyed this article, check out my other writings over at my website, sign up for my newsletter, follow me on Twitter or just wait for future articles here at The Ankler.

New on The Ankler:

A View to a Kilar: surveying the final gasp of the AT&T era at Warners.

Is anyone in charge here? Thoughts on the leadership vacuum revealed by the Will Smith fiasco.

The Transom’s got Jason Momoa going to Apple project, Kerry Washington to Hulu, and the Ted Lasso team’s next move.

The Glossy says RIP to the male’s gaze’s reign on the red carpet

10 Truths About Will Smith’s Resignation: Richard Rushfield spares no words, nor any entity.

Pod: Bruce Willis and ‘Years of Concern’: One of the reporters of the LAT’s recent article on Bruce Willis’s struggles with aphasia talks about the actor’s troubling path.

ESG on The First Hard Lessons of 2022 so far and the final numbers on Disney+’s Hamilton.

Subscribe to The Optionist

Q&A: Cons are In, Bleak is Out: With projects all over town, Truly Adventurous is changing the journalism x Hollywood playbook

This week’s picks: A Jan. 6 Family Tragedy + 7 More Finds