Follow us (and like us!) at Apple Podcasts or wherever you listen to your favorite podcasts, and follow us on Twitter. Also please subscribe to The Ankler at TheAnkler.com for more podcasts and stories like these about the entertainment industry.

Today's Hot Seat Podcast is hosted by Richard Rushfield and features special guest, media investor and analyst extraordinaire Rich Greenfield, Partner and TMT Analyst at LightShed Partners and LightShed Ventures.

Greenfield has long been one of Netflix's most ardent enthusiasts in the investment community, but in a wide-ranging conversation on the state of the media world, post-Netflix earnings, he’s changed his tune.

Says Greenfield, “If you think about the sort of rocky road, Netflix was at an all-time high in October or November, and it reminds me of the Ferris Bueller quote — things move fast. You really have got to pay attention because this industry is moving at pretty crazy speed right now.

“That's what's so scary. The reality is we coined the term #goodluckbundle cause we saw what was happening to linear television before others. The question now is everyone looked at Netflix, everyone looked at Disney and the success they had and said, ‘Oh my God, this actually isn't as hard as it looks! Wall Street will reward us! We're gonna build this massive streaming juggernaut. We can be like Netflix too!’ So everyone's all in on streaming and now you just go, holy crap, that valuation is no longer gonna be possible. Wall Street's not gonna reward us. Our legacy TV business and movie business is actually falling apart faster than we thought, because we've shifted so much content to streaming and change consumer behavior. So you can't go back to the old business. The new business is not economically as compelling as you thought it was. What do we do? Do we just keep plowing into streaming?"

RELATED: Podcast, Disney, the Heiress and a Hot Mess

And in a reversal unthinkable just weeks ago, Greenfield sees the company — now at a bargain market cap of $100 billion — as a possible takeover target for Apple or Amazon, companies he also believes will increase their production spend to capitalize on where Netflix may cut.

"If Apple wants to step in, buy it or Disney wants to step in and buy it, I think there are certainly crazier things that have happened and maybe that's the opportunity, right? While I don't think they're looking to be sold and I don't think that's the plan, obviously, I can't imagine everyone is not thinking about if you want to have a 220 million global subscriber business with a growing library with incredible tech talent, there's a way to get it. So again, another reason why people don't just abandon Netflix as a stock is that it's actually gotten to a size where it actually becomes an interesting chess piece."

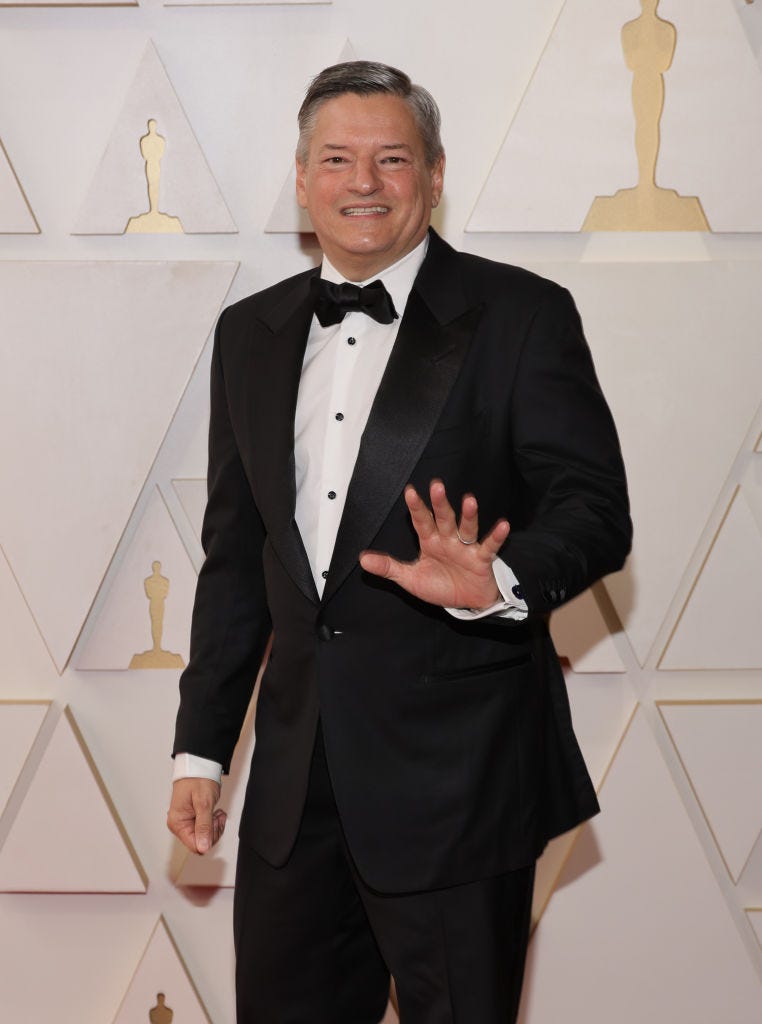

RELATED: Reed and Ted’s Very Scary Road Ahead

Greenfield also predicts a possible role for Jason Kilar, the streaming age's golden boy, who recently was exited out of WarnerMedia and launched HBO Max.

"I was just sort of thinking out loud of like, if you were, if you were gonna build an advertising-supported streaming business, who would you call? If you got one call for help, who do you call right now? Why don't you pick up the phone and call Jason Kilar who has an entire team, that's done advertising on streaming, not once but twice. And his entire team is right now sitting on the side.”

Still, he scornful of Netflix's new ad push. “It really is surprising that the right answer for Netflix is to cave on their religion of advertising or being anti-advertising. And I think that of everything that happens this week, the one that is by far the scariest, is that they're now coming to the conclusion that advertising might be the only answer.”

He continues, “When you think about Netflix and you can go through, you know, hundreds of episodes of content…how many seasons of Grey's Anatomy are there? You know, you can binge through the first three seasons of Stranger Things and you get lost. Without an ad break and the content just auto-plays, you totally get lost.”

“As soon as you start putting ad breaks in — and remember, none of the Netflix originals were made [even thinking] about with ad breaks…I don't know if you've watched Hulu with advertising lately. The experience is literally horrible. And so what happens when you see the same ad? You start to go, Oh my God! This is so painful. You start to get mad, maybe you leave the room, maybe you pick up a phone call. All it does is hurt engagement.”

Greenfield also points to the central problem Netflix faces — making more strategic and effective choices with programming that keep the audiences more deeply engaged.

“For a company that's spending $17 billion on content, the consumer zeitgeist content doesn't seem like there's been enough of it. Sure, Squid Game was amazing, probably the biggest TV show in the world of all time. They had some movies that have been good. Sure. Adam's Project. But things that have really captured the zeitgeist of the nation or of the world, I don't think there's been enough for the amount they're spending...I don't think the Netflix content over the last 12 months has been good enough. And I think that's the problem.”

A further concern Greenfield raises: recruiting and retention problems.

“I think the real pressure is it hurts morale. When you have a stock that is substantially down, where options are underwater, that's where you start to have morale issues and the risk of losing executives. You know, Netflix was a place everyone wanted to come. Who didn't want to come to Netflix over the last 10 years? It was the hot place to go. And they were basically taking talent left and right. So if your stock's not performing, and that's a large part of your compensation, that's obviously a major issue from a hiring and retention standpoint."

Elsewhere in the Streaming Wars, Greenfield sees a world similarly in turmoil, with tough decisions coming. Warner Discovery's shocking move this week to pull the plug on CNN + just three weeks after launch is a harbinger of things to come.

"I think it's a little unfair because remember David (Zaslav) is coming in as the Warner Bros. Discovery CEO, and he has cost-cutting targets he has to achieve, that he's given to Wall Street. There is no way CNN+ was in that plan. (It was just] oh my God, this is a bleeding ulcer. Let's just take it out as fast as we humanly can because we have a plan and we need to stick to it for Wall Street."

RELATED: Podcast, Warner Bros. Discovery CEO “May Have Hubris, But He’s Not Stupid”

Listen and subscribe to this podcast on Apple, Spotify or your favorite podcasting app, and remember to subscribe to The Ankler.

New on The Ankler

Great reads:

The Entertainment Strategy Guy examines Reed and Ted’s scary road post-earnings.

Florida and the Plagues of Bob II: Can an entertainment goliath survive the culture wars? Disney’s embattled CEO is finding out.

Netflix: The Reckoning. Has the bottom fallen out on the leader of the Streaming War? Analysis from Richard Rushfield.

On The Transom: Momoa + Minecraft and is 'Blair Witch' Back?

The Glossy looks at Johnny Depp, Will Smith and Fashion's "Morals Clause" Pause.

Great listens:

Pod: The Streaming Battlefield 2022 features Binge Times author Dawn Chmielewski on Hollywood’s battle to take down Netflix (prescient!).

Subscribe to The Optionist

This week: Finding T. Rex + 7 Great Picks

Q&A: Cons are In, Bleak is Out: With projects all over town, Truly Adventurous is changing the journalism x Hollywood playbook