☀️PEACOCK loses $651 Mil in Q2, COMCAST stock +7%... here's why

A24 enters Dec Movie fray / New MLB team goes DtoC Streaming / IMAX finds a profit

Mornin! This is Sean McNulty (connect with me on LinkedIn here if ya like), and here’s the Hollywood + Media news to know on THURSDAY July 27, 2023.

Where for all of my former NYC folks in LA - the city is smelling real nice today… as we hit peak July Summer 100 heat index time (SAG-AFTRA has wisely suspended strike lines here today and tomorrow).

BTW: Add the unprecedented ANTARCTICA sea ice levels not returning in the Winter to this literal climate dumpster fire of a Summer. Always nice when an inflection point in HOLLYWOOD matches an inflection point in our Earthly existence 👍.

PLUS: Here are the docus playing at TIFF this year.

ALSO: GOOGLE is now the subject of a class action lawsuit from people who bought video ads on their TrueView platform… the one that a recent ANALYTICS study said that 80% of such placements violated standards promised in the TrueView agreement.

A REST IN PEACE: Goes out to Sinead O’Connor, who died at the age of 56.

AND: As of today, Barbie will be over $500 Million global and it’s not even weekend 2 yet. Oppenheimer will be over $250 Million.

Funny how the Summer Blockbuster movies with the ‘lowest’ budgets are the ones making the most money (throw Spider-Man in there to round out the trio).

WAKEUP BOX OFFICE POLL

Speaking of - DISNEY is up to bat one last time with Haunted Mansion. Tracking & pre-sale has it around $30 Million… but sounds like some think it’s a bit high (it does get some PLF screens from Barbie).

But at a $150 Million budget (is there a DISNEY tax I’m not aware of?), better hope for the ‘over’ on $30 Mil here 😳.

IN TODAY’S EDITION

It’s free for all Wakeup subscribers! My belated birthday gift for you.

ALSO: According to my inbox, looks like the Sunday Ticket discount deals are continuing past June 👀.

📽 THE SILVER TV 📺

5 THINGS

ANGEL STUDIOS will rollout Sound of Freedom internationally starting Aug 24 in AU/NZ, soon followed by most of LATAM and UK/IRE on Aug 31/Sept 1. /Deadline

A24 is going wide with Zac Efron wrestling movie The Iron Claw on Dec 22. Remember - A24 is not a part of the AMPTP. /Variety

NETFLIX is lowering their Ad rates by about 10%, and reworking their deal with MICROSOFT per the WSJ.

HULU is doing an 8-episode reality series on Wayne Brady and his family. /Variety

The CHICAGO CUBS are next to go DtoC Streaming, as their MARQUEE SPORTS NETWORK (co-owned by the CUBS and SINCLAIR) is now also a streaming service avail for $20 a month. /NextTV

Share this newsletter 🤝 here’s a handy button:

💻 THE MEDIA BIZ

#medianerd🤓 goes deep

Huge PEACOCK losses persist, but COMCAST prospers - An Explainer

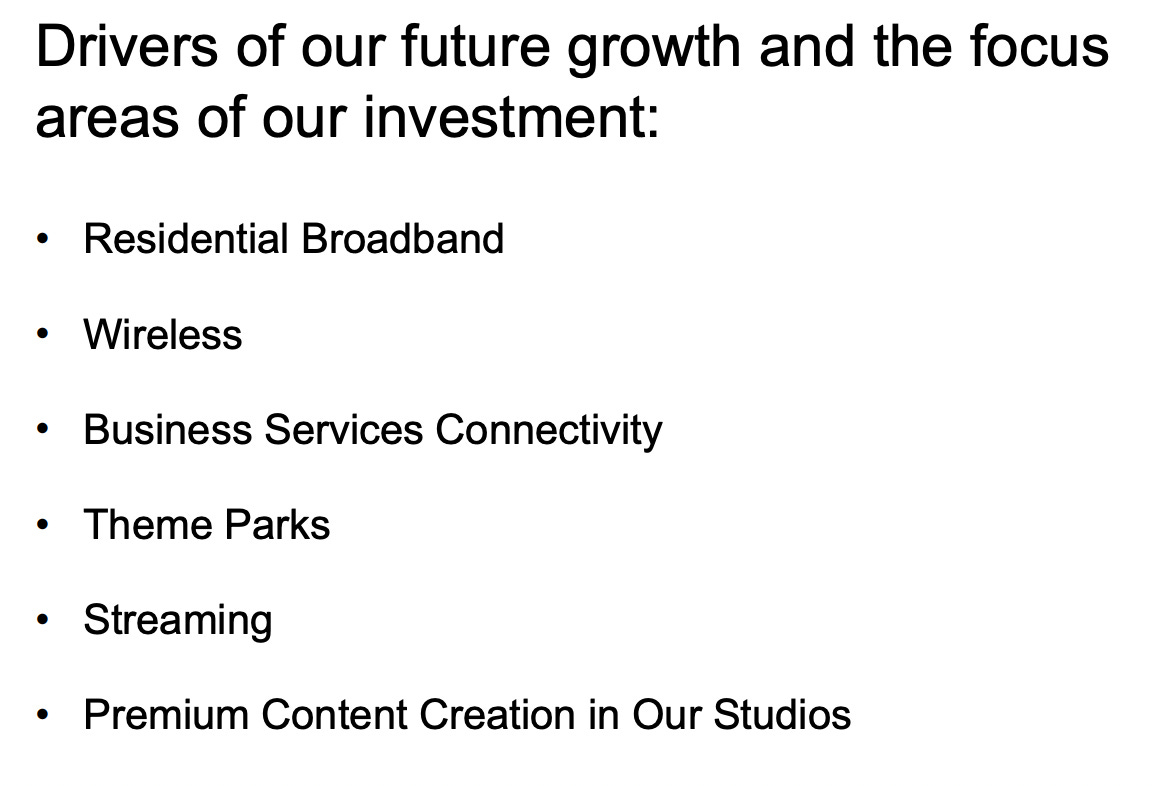

Gotta say it’s nice to see a company lay out “Here’s what our big picture plan for growth is”, and… well, hey at least NBCU made the slide somewhere 🤷♂️ (it’s good to have the last 2 slots right? #BestForLast🥴).

What’s not on here? Anything with the word TV in it - no “Cable TV Business”… at the #1 Cable TV Bundle provider in the US, or “Broadcast TV”… at the home of NBC. 😲

FOLLOW THE MONEY: Over 90% of COMCAST’s $10 Billion Q2 profitability comes from Broadband (US & Int’l), US Mobile service, the Cable TV biz (still), and Theme Parks.

Where does a good deal of this $$ go?

Over $1 Billion in Dividend payouts (rewards Wall Street investors)

Over $2 Billion in share buybacks (rewards Wall Street investors)

Investment in Broadband speed Capital expenditures

Below VP-level and below Employee bonuses! 😂 (sorry, I got bored during the Mobile phone questions portion of the earnings call, gotta entertain myself).

TOPLINE ITEMS:

They’re basically a hard pass on the ESPN business, thanks for asking.

NBA rights… they’ll take a meeting (Cavanagh comments below)

No mention or questions on USA WWE TV deal renewal.

Mike Cavanagh kept the Strike talk minimal, and along the company lines of hoping it’s resolved soon etc… but Mike was generally non-plussed here, and it did not factor into any financial guidance in the future. More below.

Cord Cutting is getting worse.

No real optimism the Video Ad market will have improvement in Q3.

No mention of the upcoming HULU/DISNEY thing.

PEACOCK still has massive losses with no profitability plan.

BUT: Remember, they’re really a Broadband & Mobile company, and that’s how Wall Street grades them essentially.

Here’s the breakdown…

Q2 CORD CUTTING

They lost another -543k Cable TV bundle subscribers in Q2. This is up from -521k a year ago.

First half of 2023 Cable TV bundle #cordcutting loss has gotten 11% worse vs. the first half of 2022.

SUBS: 14.98 Million

REVENUE: $7.3 Billion, a decline of -5.5% vs. a year ago

BROADBAND & MOBILE

BROADBAND subs were -19k in Q2.

Total is 32.3 Million subs, so this loss is a very small drop in a bucket…

But it’s not great to see a negative here.

“Over time we’ll get back to subscriber growth”… That timeline was not delineated, and didn’t sound soon.

Broadband ARPU: +4.5% vs. a year ago.

Translation: Our customer base isn’t growing, but:

We’re charging people more $ for it.

TV Cord-Cutting actually helps us.

As people “de-bundle” and go Broadband-only, we lose the TV money…. but they pay a higher Broadband bill as the ‘bundle discount’ disappears.

More people are upgrading their speeds to plans with higher margins for us.

1/3 of Broadband customers take 1 Gigabit or higher plans.

I.e. This is why we’re spending so much capital (💰) to upgrade our wires and increase the reach / # of homes that have access to higher speed capabilities.

MOBILE subs were +316k in Q2.

This growth matched Q2 2022.

Total is now 6 Million Subscribers

Only 10% of Broadband subs also take COMCAST MOBILE subscriptions, so they see a lot of upside here to sell more people in.

Yes, this is competition with AT&T, VERIZON and T-MOBILE

Note: The later 2 companies there are stealing Cable Broadband subs with their FWA/Broadband over 5G services.

Broadband & Mobile are a flat circle.

TO NOTE:

US & Int’l Broadband & Cable and US Mobile are almost 4X as profitable as NBCU, incl the Theme Park Business… which has the biggest profitability growth at NBCU by far.

Q2 NBC and Cable Networks Profitability: $1.2 Billion, -18% vs. a year ago

Q2 Theme Parks Profitability: $833 Million, +32% vs. a year ago

PEACOCK

Q2 LOSS: -$651 Million 🤦♂️

Increase from -$457 Million a year ago

Paraphrased analyst question:

“Is a $3 Billion PEACOCK loss for 2023 still accurate, and any guidance on when PEACOCK will become profitable?”

Yes on $3 Billion loss, and… literally did not answer on profitability.

SUBSCRIBERS: 24 Million (+2 Million from Q1)

This is mainly from COMCAST Cable & Broadband subs who previously got PEACOCK for free, now signing up for paid accounts.

They expect Sub growth in the 2nd half of the year… but did not delineate any specifics.

Q2 REVENUE: $820 Million

This translates to a #BackOfNapkin ARPU of $11.40 a month… and they’re still losing -$651 Million a quarter 🤯.

PEACOCK makes as much money from Ads as they do Subscriber fees:

Q2 PEACOCK AD REVENUE: $367 Million (+77% vs a year ago)

Q2 PEACOCK SUBSCRIPTION REVENUE: $361 Million

Subscription Revenue-based ARPU: $5 a month

$92 Mil is listed as Other (not broken down further).

PEACOCK spend is now at a $1 Billion a quarter clip in 2023

That’s more than +70% vs. a year ago.

So… no cutbacks here, a la DIS, PAR & WBD.

Marketing Spend is also up roughly +33% vs. last year, to $419 Million in Q2.

OTHERWISE HERE:

SPORTS value is “very substantial” to PEACOCK.

SPORTS was also listed as big driver of BROADBAND use.

Regarding the upcoming NBA Rights auction - Cavanagh: It’s a “fantastic property,” we’ll look at it… but we don’t “need it”.

Top 2nd half of 2023 listed PEACOCK Programming highlights:

UNI Movies (have you heard of Super Mario?)

SPORTS (NFL, BIG10 College Football)

BRAVO

Not mentioned on this list: PEACOCK Originals, and naturally NBC Fall “programming”.

HULU / DISNEY thing: Zero mention

ALSO: We’re not interested in an ESPN equity swap with DISNEY… or ESPN in general, per Mike Cavanagh.

THE MOVIE BIZ: The MARIO Halo

(and yes, I know I’m mixing 2 different video games there)

Mario was very big on this on the call (sadly no one did a Luigi voice)… but good luck to the Movie Biz comps in Q2 2024.

Q2 REVENUE: $913 Million (up from $550 Mil a year ago)

That’s from a lineup of:

Renfield (loss of at least $55 Million, not incl Mtkg)

Super Mario Bros (roughly +$1.1 Billion in the black, not incl Mktg)

Fast X (basically break even when you account for the CHINA $ cut)

A mix of FOCUS misses (Polite Society, Book Club 2, and whatever math you’d like to ascribe to Asteroid City)

Not sure how they count Ruby Gilman with a June 30 release… but guessing it’s Q3.

So. That $913 Million is basically what’s left out of Super Mario profit. #HitsPayForTheDuds

Super Mario Bros also represents pretty much the entire Q2 Studio group profitability growth at $255 Million.

ADVERTISING

Not good. Total Ad Revenue: -7% in Q2

Q2 Domestic TV Ad REVENUE: $2.02 Billion, -5% vs. a year ago

COMCAST Cable biz Ad Revenue was -10.7% (this isn’t NBCU Cable Network revenue, but rather comes from local TV Ad inventory COMCAST gets from all Cable Networks they carry).

The Ad business was not even mentioned in their Earnings Call opening remarks (and minimally mentioned in their financial remarks).

Zero mention from execs themselves on the Upfronts, but a thanks to analyst Jessica Reif Erlich who was the only person to ask about this.

Cavanagh: Total cash was similar to last year… but that’s about all he had to say.

The “soft” Ad market is not expected to improve in Q3.

THEME PARKS

Killin’ it.

Q2 REVENUE: +22% ($2.2 Billion)

Q2 Adj EBITDA: +32% ($833 Million)

OTHER NUMBERS OF NOTE

$3.4 Billion of Free Cash Flow

Debt Leverage is a healthy 2.4X

TAKEAWAYS

NBCU is a Studio that exists within the country’s #1 Broadband company. It’s nice… but it’s the short film that plays before the main Broadband/Mobile movie presentation here on Wall Street - and PEACOCK is a trailer before the short film called “Dude, Where’s My Cash?”

We’ll fittingly give the Cable TV Bundle business the end credit blooper reel.

Hence Mike Cavanagh sounding rather non-plussed about the Strikes, giving no material guidance as to how it might affect their businesses… other than we’ll probably have a little more Free Cash Flow in 2023… and a little less in 2024.

No mention of the Fall schedule, NBC in general, the effect of Cord Cutting on Revenues, etc.

ALSO: For a company whose Ad Revenue was down -7%… they didn’t sound too concerned there either.

As for PEACOCK - it makes over $11 a customer per month… and is still losing $3 Billion a year… with no timeline to be profitable… despite the gist on the call being PEACOCK / Streaming is where we see the future of our TV business (I don’t believe the NBC network was mentioned once on the call, and the Cable TV Network business certainly was not).

BASICALLY: PEACOCK spending is way outta whack somewhere - but unlike Zaz and Iger, they seemingly have yet to really taken any steps to dial it in.

AND AGAIN: Given PEACOCK exists as a small item line at a Broadband company, Wall Street doesn’t really seem to care. At least this quarter. Super Mario money is very distracting.

IN SUMMATION: They are all about:

Increasing profitability from Broadband

Growing Mobile subs

Leaning into Theme Parks even more (DreamWorks Animation land!)

We like the Movie business

As for TV Studio biz: My thought is it will increasingly become even more like a SONY or WBTV - a Studio truly selling to all, vs. any emphasis to supply NBC, the Cable Networks (who are not in scripted originals anymore anyway) or PEACOCK with series.

The new Donna Langley oversight here is a further step in that direction. #NewPOV

And… I guess there’s a plan for PEACOCK 🤷♂️, but they’re not sharing it.

At the moment it seems to involve more Sports, and less PEACOCK Originals (more because they didn’t mention them at all - again, no specific pullback was stated).

But that omission could also be affected currently by the Strike.

OTHERWISE: COMCAST is managing their other, non-growth businesses as they decline.

Cable TV Bundle

Landline Voice service

NBC & Cable TV Networks

Aka cutting them to the bone to continue to get as much money from them as they can, until maybe they sell them off for parts one day if need be… with no real investment to turn them around as they’re in secular decline.

COMCAST stock was +7% this morning.

If you liked this COMCAST breakdown… I did the same for NETFLIX Q2 here 👇

AND: Will be doing WBD, PARAMOUNT, DISNEY, ROKU, ENDEAVOR and more in the next couple of weeks - for Ankler subscribers only:

META makes… even more money in Q2

In the words of Zuck, “We had a good quarter.” Well - save for those thousands of people who were now out of a job in said quarter… they may have a different take.

Year-over-Year, META’s employee headcount is -14% to about 71k people.

But I mean the main numbers here are just 🤯, esp if you think of the $$ involved here in terms of HOLLYWOOD/Streaming comps.

$32 Billion of Revenue in Q2 (aka a 3 month period), +11% vs a year ago.

Lending more support to a Digital Ad market stabilization… although META’s Ad Revenue Sources pie is much more complex than Streaming/TV.

NETFLIX was $8.2 Billion. YOUTUBE $7.7 Billion. DISNEY Q2 last year was $21 Billion (incl theme parks).

$7.8 Billion of Profit

$53 Billion of 💰 on hand

3.03 Billion people log into FACEBOOK monthly

2.06 Billion use FACEBOOK daily

This includes 202 Million people in US/CAN alone. Every day.

That’s actually an increase of +2 Million from Q1.

These are likely folks who were Monthly users who became Daily users vs. new user sign ups… but no real definitive insight there.

OTHER NUMBERS OF NOTE

Ad Impressions across all apps (IG, MESSENGER, WHAT’S APP, FB) were +34%.

Translation: As anyone who uses IG knows, we’re stuffing our products full of more ads. Hey it worked for Cable TV right? (Plus likely some increased engagement factoring in too).

Avg Price per Ad was -16%.

Translation:

A) Because we’re stuffing so many in there, we can’t charge as much for each Ad… but in aggregate we make a lot more.

B) Most of our user growth is in APAC and “Rest of World” - i.e. places where we can’t charge anywhere near as much for Ads.

REALITY LABS numbers (i.e. home of Oculus, the Metaverse spending etc).

Q2 REVENUE: $276 Million, -40% from a year ago, or 0.08% of total META Revenue ☹️

Q2 LOSS: -$3.7 Billion in 3 months, projected to go up in 2024, and up about $1 Billion from a year ago.

Nice to have a company where you can say “Don’t mind that nearly $4 Billion of Quarterly losses in the corner, it’s fine 😁” and still have your stock +9% in after hours trading last night.

NOTE: Still no updates on how many takers they’ve had for their META VERIFIED program since they launched it in March, as far as I’ve seen out there (i.e. their version of TWITTER BLUE).

IMAX has profitable Q2

Ah that Super Mario…and Spider-Man…and Guardians.

Revenue was +36% to $98 Million, or about 36% of total Global Box Office Revenue at IMAX theaters (which was $268 Million).

Profit was $8.4 Million, compared to a $2.9 Million loss a year ago.

Cash on hand is $95 Million, Operating Cash Flow for the first half of 2023 is $26 Million, so these folks are doing well… unless the Q4 theatrical lineup disappears 😳.

If you were forwarded The Wakeup, get it as part of your subscription to The Ankler:

Hits your inbox weekdays by 9am (ish) East Coast time

🏦 STOCK NOTES

SPOTIFY +6% ($149.13)

ALTICE +6% ($3.40)

GOOGLE +5% ($129.66)

LIONSGATE +5% ($7.47)

WARNER MUSIC +5% ($31.66)

DISH -6% ($7.22)

👩💻 NEW TO WATCH:

PEACOCK Twisted Metal series

NETFLIX Happiness for Beginners - Ellie Kemper romcomdram pic

MAX Harley Quinn Season 4

🎥 TRAILER HOUSE

APPLE TV+ The Morning Show season 3 teaser - No mention of ARPU or adjusted EBITDA here. PREMIERES SEPT 13

HULU Only Murders in the Building season 3 trailer - PREMIERES AUG 8

HBO Telemarketers trailer - 3-part docuseries about the telemarketer scammers and a long-play undercover plan undertaken by 2 guys to blow the whistle. PREMIERES AUG 13

APPLE TV+ season 2 trailer - PREMIERES AUG 23

NETFLIX Depp v. Heard docu trailer - In case for some reason you need more of this. PREMIERES AUG 16

🎧 PLAYING ME OFF

New Chris Stapleton! Looks like we have a new album this November, and here’s the first single “White Horse”.

If you need some new tunes:

Email me anytime at seanmcnultynyc@gmail.com or connect here on LINKED IN.

-SEAN MCNULTY

@theseanmac on TWITTER

@TheWakeupNews on INSTAGRAM

Great Comcast breakdown, thanks!