Judge Judy v. Amazon Judy: The Verdict is In!

Oh streaming: ESG finds more people watch her CBS reruns than her new Amazon show

Given the chaos of the last week—is “chaos” too strong a word? not at all—a narrative has partially emerged from the rubble. On the one hand, streaming doesn’t have the infinite upside Wall Street expected. On the other, linear TV is still “collapsing”.

What’s a legacy/traditional studio to do?

First, question the assumptions above. Streaming will likely be a worse P&L business than traditional TV distribution. Anyone who didn’t see that had it wrong. But someday the insane spending wars will calm down and some profit will be eked out by streamers.

But as for its own “collapse”, I think legacy studios really should question the newfound conventional wisdom.

Don’t get me wrong. Traditional TV — think the type distributed through wires and owned by “MVPDs” like cable or satellite companies — is NOT a growth industry. It’s shrinking year-over-year by most metrics.

But how quickly is it shrinking (or “dying” if you want a more dramatic headline/verb)? If it’s declining by 15 percent year-over-year that’s much different than if it shrank by, say, 2 percent. And is the acceleration of that decay growing or holding? If I had an easy answer, I’d give it to you. (Covid-19 actually slowed the decay and virtual MVPDs are growing. See, it’s complicated!).

Meanwhile, all the hype has been on the streaming side of the equation. Squid Game this! TikTok that! Turning Red this! If you want sexy headlines, you write about crazy social or streaming numbers, not “old people” Jeopardy syndication ratings. But that doesn’t make the Jeopardy ratings any less relevant.

Over the course of 2022, I plan to make just those comparisons between linear ratings and streaming. A lot of folks may be surprised just how many Americans still watch traditional, boring broadcast channels and cable TV.

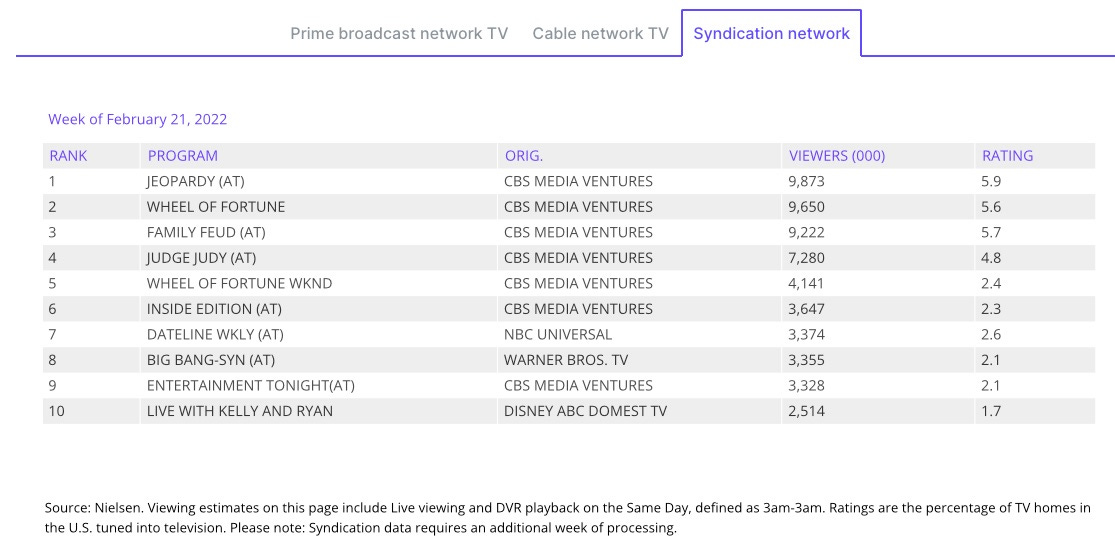

Let’s start with syndicated content. Each week, Nielsen releases a top 10 list of broadcast, cable and syndicated content (in addition to their streaming top 10 lists).

Here’s an example from the week of 21-February-2022:

This is a good time to remind everyone of the 5Ws for this data set. So we can make our comparison “apples-to-apples” later down below. These are…

What: Average viewers per minute

What: For 10 episodes (30 minutes each) of Judge Judy airing twice weekly

What: Watched on the same day they aired

Who: On broadcast TV

When: For the week of 21-February

Where: In America

Source: Nielsen

To interpret this data, when Judge Judy gets 7.3 million viewers tuning in, that’s the average number of people tuning in live or later that same day, averaged across the weekly broadcasts. Some episodes will have more, some less, but on average 7.3 million people watched per minute across that five hours of content. (And this includes folks watching the commercials. (For the record, I have 13 out of 18 weeks of syndicated ratings data for Judge Judy from Nov. 1, 2021 to the end of February 2022.)

Consider that our “broadcast” side of the comparison we’ll make today. Now let’s turn to the streaming comparison.

The crazy part about Judge Judy is CBS Media Ventures isn’t actually airing live episodes anymore! Judith Sheindlin left CBS to make Judy Justice for IMDb TV in 2021. (For quite a pretty penny too. Amazon is paying her an estimated $25 million for 120 episodes.) CBS is recutting old episodes, essentially airing reruns. (They also paid Sheindlin handsomely, forking over $97 million for the rights to her old episodes.)

So how has that new Amazon/IMDb TV/now Amazon FreeVee show performed? Well, it just got renewed and fortunately for us, Amazon provided us with one of its rare “datecdotes”:

Let’s piece together the same “Data 5Ws” for Judy Justice:

What: Total hours viewed

What: Of all Judy Justice available episodes

Who: On IMDb TV (now named Amazon FreeVee)

When: For the four months from November 2021 to February 2022 (18 weeks)

Where: U.S. and U.K.

Source: Prime Video

To make a comparison, then we need to do some conversions. First off, we need to convert the average viewers provided by Nielsen to total hours viewed, which we can do since we know Judge Judy episodes are 22 minutes long, airing twice a day. Next, we need to make the time frame the same, by averaging Judy Justice’s run for one week.

Lastly, these numbers are U.S.-only versus the U.S. and U.K., but let’s assume most of IMDb TV’s Judy Justice’s viewership came in America. Cool?

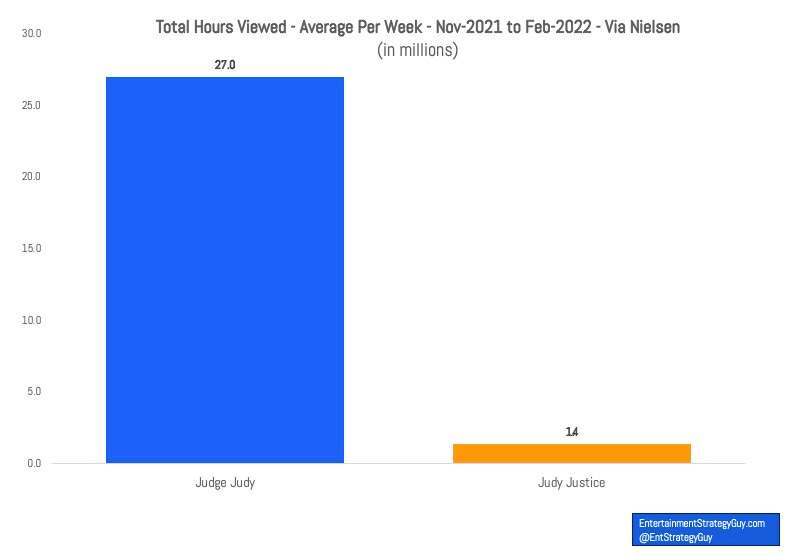

Okay, so here’s how many people watched Judge Judith Sheindlin on broadcast vs streaming…

I mean, did you do the math ahead of time? If 7.2 million people watch just 44 minutes of Judge Judy — again I excluded the commercials to make this “apples-to-apples” — on broadcast every day…then nearly as many people watch RERUNS of Judge Judy (26.6 million hours) on broadcast in a week than have watched on IMDb TV since the new show launched (25 million hours)!

What Does This Mean?

To start, don’t take this to mean I don’t like this deal for IMDb TV Amazon FreeVee.

When you’re running a “FAST"— a free-ad-supported, streaming TV service, like Pluto TV or Tubi, with a grid set up with programs running like linear TV — your content needs to match the style of distribution. That means “lean back” content or stuff folks don’t need to pay too much attention to. Cheap reality legal shows like Judge Judy fit the bill. And she’s the biggest draw in that genre.

And let’s not bury Amazon for these early numbers. Amazon FreeVee wasn’t ever going to catch syndicated TV’s viewership in the first year. C’mon. So long term, it’s probably part of the price they had to pay. (Honestly? Paramount+ is the biggest loser here. This would have been great content on Pluto/Paramount+.)

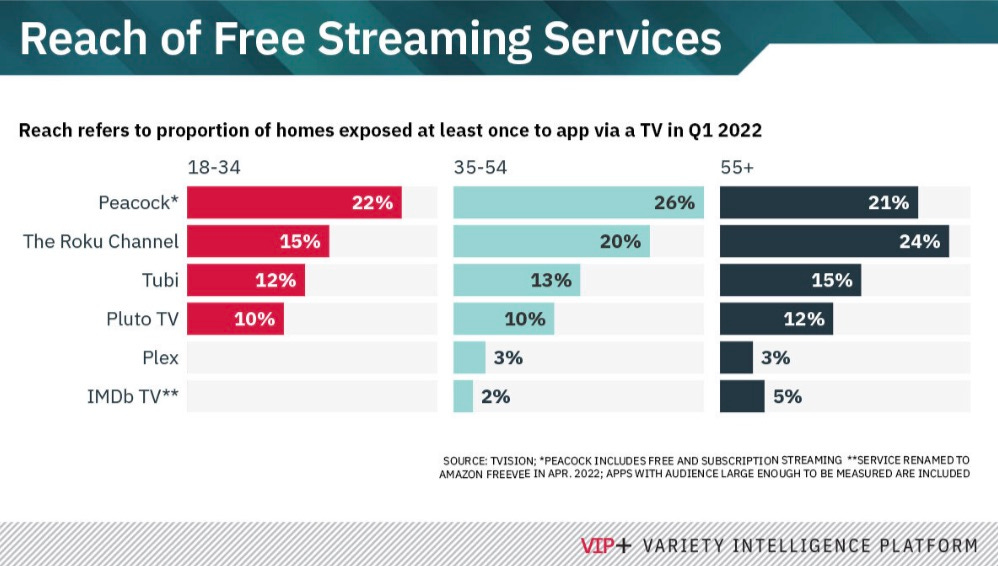

That said, I saw this chart on usage on Variety’s Twitter feed this week, and yeah Amazon FreeVee needs to catch up:

Source: TVision via Variety VIP

(As I wrote this week at my website, this is why I think Netflix should merge with Roku.)

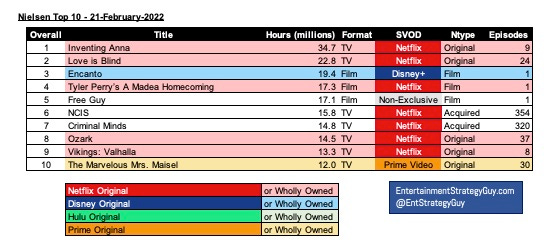

This is a reminder that — despite our own viewership preferences — we often hyperbolize how many people are watching streaming, and especially even smaller services like FreeVee. A lot of the hype around streaming doesn’t match the viewership reality on the ground. Just this month Nielsen tracked streaming’s highest usage to date…and it still well lags broadcast and cable combined:

Source: Nielsen

Or consider this: for the week of 21-February, linear Judge Judy, if thrown in the streaming mix, would have been the second most consumed show on streaming!

Some parting words no doubt made more obvious in the past 10 days: If you’re an entertainment exec, dev exec, or run an entertainment conglomerate, don’t shift your whole business model and strategies to a post-streaming world when a lot of money remains to be made in the linear version of that world. You’ll need a strategy that takes advantage of both.

I’d add, this is also a reminder that the viewing habits of many folks on the coasts of America — the types who work at big Hollywood studios — don’t match most Americans. The smart executives in TV realize this. The others work at studios or streamers that will struggle in the next stage of the streaming wars.

If you enjoyed this data dive, check out my other writings over at my website, sign up for my newsletter, follow me on Twitter or just wait for future articles here at the Ankler.

New on The Ankler

Great reads:

CinemaCon: Disney, Uni and the Tale of Two Slates, and don’t miss Day 1 and Day 2 of full coverage from Richard Rushfield and Jeff Sneider on the scene.

8 Thoughts about Hollywood’s Hell Week: Richard sorts through the wreckage of an industry’s comeuppance.

The Entertainment Strategy Guy examines Reed and Ted’s scary road post-earnings.

Florida and the Plagues of Bob II: Can an entertainment goliath survive the culture wars? Disney’s embattled CEO is finding out.

Netflix: The Reckoning. Has the bottom fallen out on the leader of the Streaming War? Analysis from Richard Rushfield.

Great listen:

Pod: Netflix Becomes a Takeover Target. Media Analyst Rich Greenfield on who could buy it and why, and the idea of, yes, Jason Kilar joining the company as they move into ad sales.