When Does Linear TV Actually Die?

Deep into what I know (and don't) about the legacy golden goose and why streamers should care

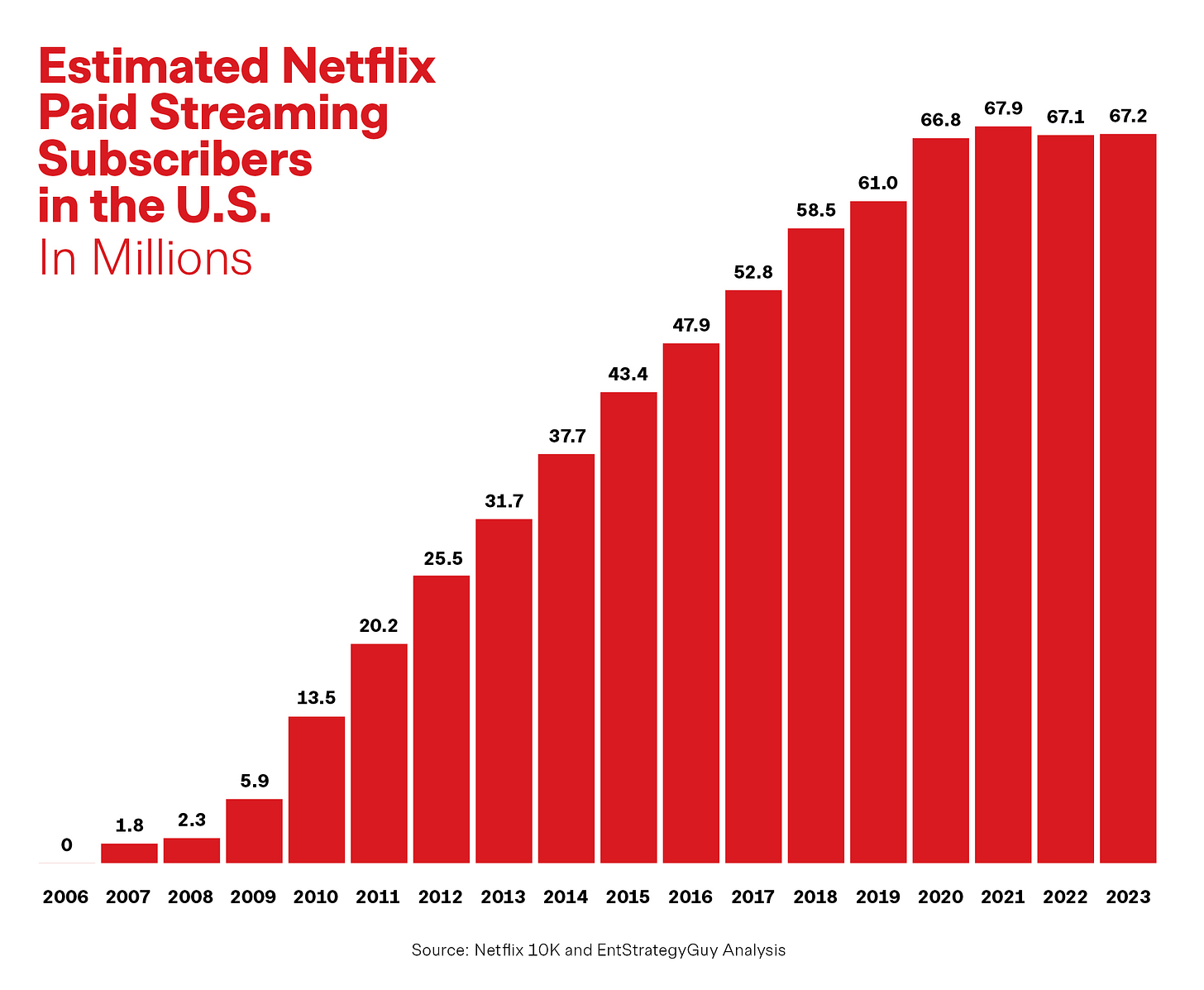

One of my big “I called it” moments of the last few years came in 2022. Back in the heady days of 2019, you could still find analysts forecasting that Netflix would just keep growing and growing. Many investment banks thought Netflix would ultimately end up with 90-100 million subs in the U.S. alone, just like cable TV. That seemed a pinch aggressive to me, so I built a model to test that theory and it spit out that…

…Netflix would end up with around 65-70 million subscribers in the U.S.

Sure enough, fast forward to last year and Netflix was basically flat in U.S. customer growth:

That’s right. Since 2020, Netflix has basically been flat in the U.S., hovering between 66.8 to 67.2 million subscribers. My model was right on! 1

If Netflix had 20 million more U.S. subscribers, as some predicted, that would mean, at $16 ARPU (average revenue per user), the streamer would have another $3.8 billion a year in revenue. That matters. And this is why accurate modeling matters.

Today, I’ll attempt another prediction: the future of cord-cutting. If the linear TV bundle dies in three years, that’s a much different business environment than if it dies in 15. What if a zombie pay TV bundle lives on, with 30-40 million subscribers hanging on? What happens to live sports and awards shows? If pay TV economics collapse, so too does traditional distribution?

This is tougher than forecasting Netflix’s sub growth, as I’ll explain. I don’t have an easy answer. Frankly — frighteningly — neither do the CEOs running major entertainment companies.

Why should we care? The old TV model had multiple sources of revenue — affiliate fees, advertisers, Pay-1 windows, syndication. Streaming has… just one. With all but one streamer in the red (Netflix), the complete loss of traditional TV revenue could have dire consequences, particularly at a time when the WGA (and eventually the other guilds) will be asking the conglomerates to cough up more (and CEO pay and results are under a microscope).

In this issue:

I’ll chart what three different companies estimate is the pace of cord-cutting over time.

Why the world view of David Zaslav vs. Reed Hastings matters in the outcome.

Then I’ll show what the data implies about the rate of cord-cutting i.e. when will traditional linear TV actually “die”.

What live sports have to do with it.

Even if we can’t put a true end date on it — there are just too many variables — we will dive deeper than the constant headlines about “the death of broadcast TV” to understand the numbers in context.