☀️ WBD & PAR Hit Stock Bottom, AMC NETS Craters

NETFLIX Xmas NFL ad rates leak / APPLE sets pic thru WB / NBA ratings hit new Finals low

Mornin! This is Sean McNulty (connect with me on LinkedIn here if ya like or email me at seanmcnultynyc@gmail.com), and here’s the Hollywood + Media news to know on TUESDAY, June 18, 2024.

Where a kudos to the BOSTON CELTICS for now having the most NBA titles of all time (sorry L.A.).

HOWEVER: The NBA game 4 blowout on Friday night was also a TV ratings blowout for ABC . . . but not in the good way.

AND: With last night’s NBA Finals game 5 blowout . . . I wouldn’t be too optimistic for that ABC audience tally either. Not great timing for a league that’s sealing its new media rights deals (not that this will affect any 💰 #s for the NBA here). But, maybe Zaz isn’t on the wrong side of this thing after all.

Yes, I recognize the T-Nets future affiliate fee / WBD revenue issue here (no NBA = cable companies may very well pay WBD less to carry the networks).

But at this point, just having a declining “advertising + affiliate fee” business model, without the large reach of a broadcast TV network, makes it hard to justify laying out huge sports costs anymore.

COMCAST obviously is prioritizing sports at PEACOCK, but bigger picture — its core broadband business also benefits from more sports streaming (customers will need higher speeds to stream sports and do other things at the same time online, and higher speeds = higher bills 💰).

AMAZON can justify it as gaining more audience data to sell products and customized advertising, and increase its relationship with big ticket advertisers overall.

DISNEY . . . well, it’s a little murkier here — it does have an ESPN D2C product to launch in 2025, and it also has ABC, which delivers the reach factor for the league and big ad 💰 rates.

WBD has no broadcast network, dedicaed sports streaming service or ancillary/third business to tie in to justify a massive NBA rights deal pricetag.

Note: This “no ancillary businesses outside of affiliate fee + advertising” is also the issue at PARAMOUNT, and part of the reason why PAR and WBD stocks are both where they are (more below today on that).

SPEAKING OF TV AUDIENCES: The Tony Awards got just 3.5M viewers in preliminary CBS numbers on Sunday night, -15% from last year . . . but we’ll see where the final numbers come in. PAR+ numbers are not known.

Going up against the GOT: HOTD premiere may not have helped the cause.

NBA FINALS AD GAME:

GOOGLE’s YOUTUBE TV was the big winner in this series . . . with branding all over the place throughout the games, and — YT bought out the ad inventory for the final 5 minutes of gametime in the 4th quarter last night, so it could be presented ad-free (well, except for YOUTUBE TV ads).

Which is even more, uh, impressive . . . given that DISNEY has its own product in the exact same business (HULU+LIVE TV), which naturally has had zero presence.

ONTO THE MOVIE BUYS:

SONY clearly bought out the first ad slot in all games for Bad Boys 4, but it also had a nice surprise with a Fly Me To The Moon spot in the 1st quarter.

OTHERWISE: UNI Despicable Me 4 (2x) and Twisters; WB Horizon and Trap; PAR A Quiet Place 3; FOCUS Bikeriders (15 sec. spot); and DIS Inside Out 2 and Deadpool 3.

AND: APPLE TV+ came through with a halftime spot for Boston’s own Matt Damon & Casey Affleck, spending for an ad for The Instigators.

PLUS: 2010s sitcom ad campaign reunions are hot — first The Office for AT&T earlier this year, and now Modern Family for META/WHATS APP. Gonna have a problem here when trying to do this in about 4-5 years. #NoMoreSitcoms

NOW: No more mass audiences like this on TV for 6 weeks. #ParisOlympics

BTW: Advertisers — here’s what you’re getting as you shift those TV dollars to “targeted” social media buys. This is a tremendously disturbing but not at all surprising read from the WSJ in its ongoing reporting on how teen / young women INSTA influencer accounts have a large percentage of . . . male followers.

It centers on a teen girl who created an account managed by her mom, to focus on her daughter’s dancing and modeling posts — the account built up to a point where brands began reaching out to advertise, and it had a follower base that was 92% men.

Her mom, who helped run the account, had to decide between blocking men who would make creepy comments at the risk of lowering the “engagement” of her account, and thus potentially lowering the money 💰 they were getting from META . . . which the mother hoped to use for her daughter’s college education.

This is on top of previous reporting at the WSJ and elsewhere showing the significant sexual predator problem INSTA still seems to have . . . in 2024. 💩🔥

BTW: Generative AI “contributed to 23% growth in new fraud schemes in 2023, leading to a 58% increase in ad fraud on streaming platforms” according to a new study by DOUBLE VERIFY.

THEN: Life’s getting harder out there for influencers in general, according to another WSJ read, as brand dollars and social media creator payments are not what they used to be.

Only 13% of influencers make over $100k a year according to an influencer marketing agency.

One creator reported only getting $120 for a video with 10M+ views.

Another has over 1.8M TIKTOK followers, and gets . . . $12k a year from TT, plus about $5k from selling merch.

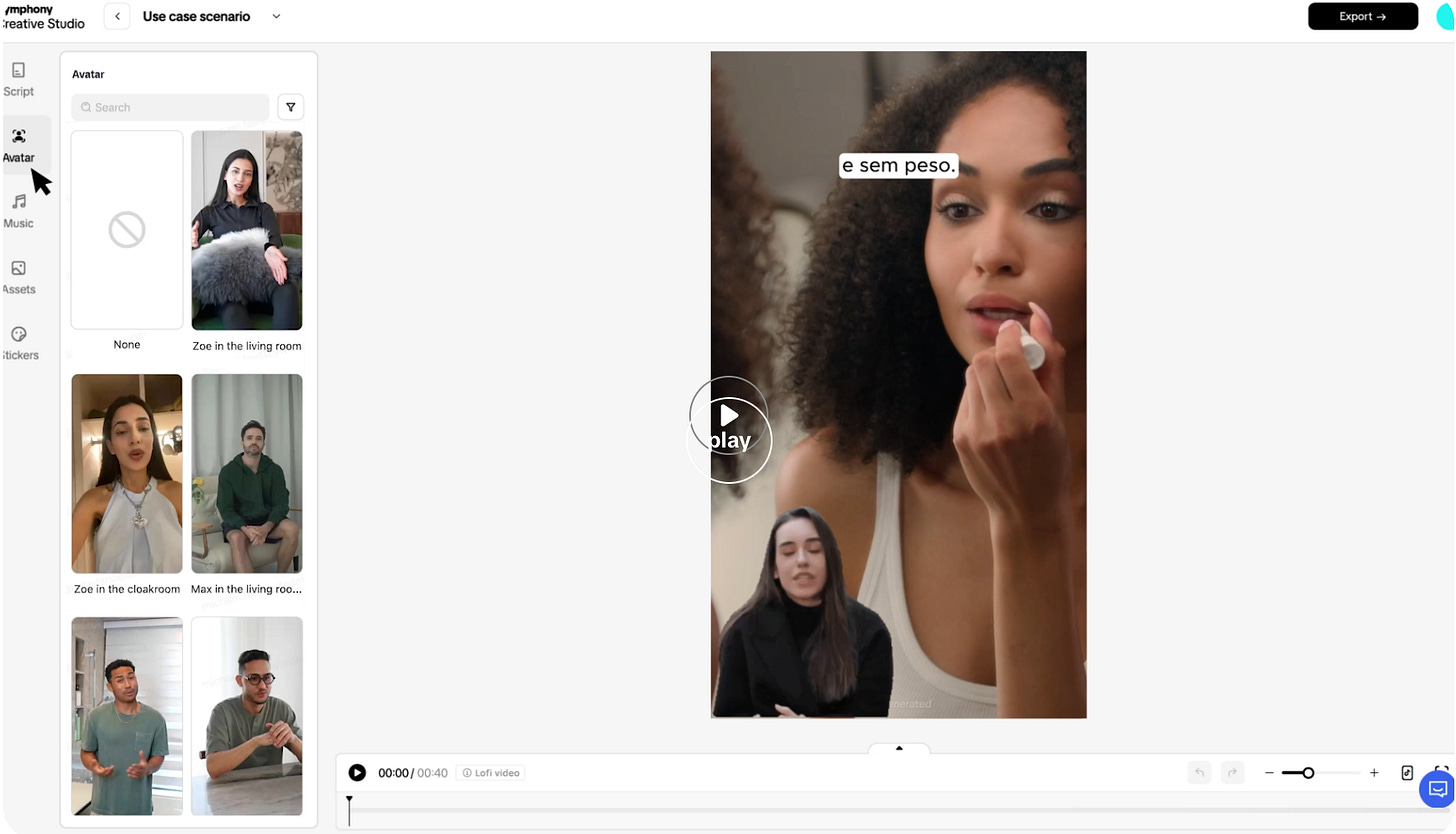

OH: Influencers, you’re also being replaced by AI — TIKTOK announced a new tool that lets advertisers use AI-generated avatars to sell their products.

You can choose from a stock avatar “created from video footage of real paid actors,” 🎭 or hey — just replace your own spokesperson with a custom avatar.

YEAH: Copywriters, you’re being replaced too — the new TIKTOK tools will also create copy for you from inputting your product details.

Really hope the AI-generated TT accounts that I’m sure will arise soon to “watch” all of these ads enjoy the future of social media.

Anyone seen all of those human jobs that tech leaders promised will be created as a part of the AI revolution around here somewhere?

BTW: Median CEO pay for S&P 500 companies rose 13% last year, the fastest rate in 14 years according to the FT. Average workers saw a +4.1% bump.

ISS put those median comp numbers at $15.7M for CEOs, and $81k for employees at S&P 500 companies.

IN THIS EDITION

Speaking of worker comp — I’ve added in a brand new weekly GET A JOB section, with gigs across Marketing/PR/Comms, Production/Development, Media Production and good Assistant gig jobs I see out there — including what all of these jobs pay (thanks state regulations!). I hope to build it out a bit more in the future, and it’ll be in Tuesday Wakeup editions going forward this summer.

Things are getting real on Wall Street for the cable TV bundle-tied stocks like PAR, WBD and AMC NETWORKS. A look at the numbers and comps to know.

NETFLIX’s Christmas Day NFL advertiser offering deck got out there . . . the numbers to know from ad rates to audience expectations, and how they comp to linear TV.

SONY TV continues to believe in writer deals, WB and LGF pick up notable film distro deals, HBO keeps adding NFL programming and much more