Wall Street’s Brutal Verdict on Hollywood ’26: Versant Fumbles, AI Buyers, Family Office Cash

Pros from TD Cowen, Integrated Media, Magid, Gamco and more map what’s coming for Disney, WBD and media as generational change arrives

I’ve written for The Ankler about Wall Street analysts’ impact on Hollywood and falling TV news salaries, and I joined Gregg Kilday for the Ankler’s on-the-ground Cannes coverage in partnership with Screen International. I also write The Media Mix newsletter.

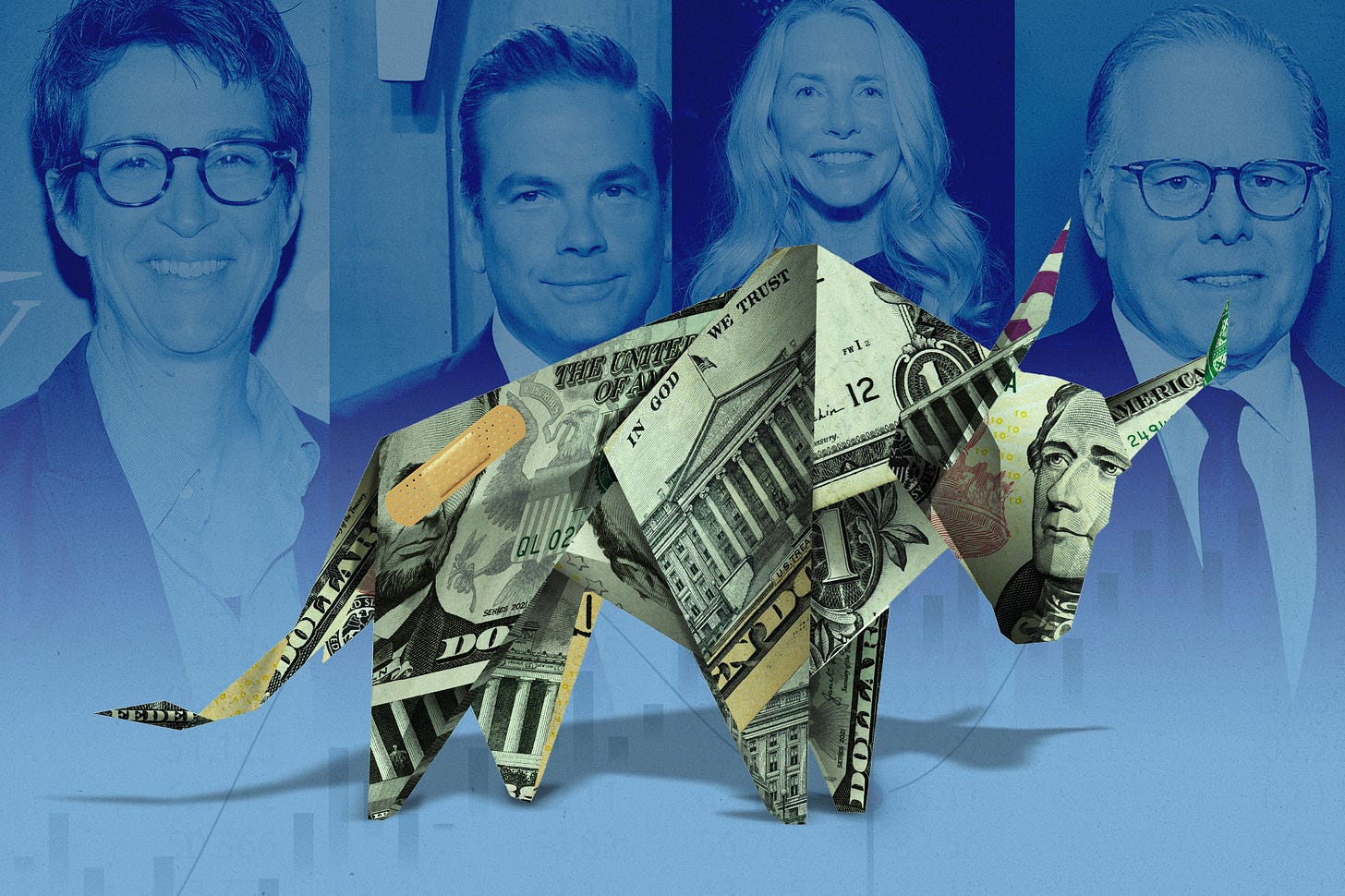

Investors could be forgiven for wondering how to consider the media-tech space in 2026. Fleece-vested media CEOs are running plays for the new year like Succession’s Logan Roy in the sandhills of the Hamptons, though a handful of veteran operators could be stepping out of the picture. Warner Bros. Discovery chief David Zaslav, after a likely sale; Disney chief Bob Iger with his second retirement; and perhaps even Comcast chief executive Brian Roberts may not be in their same posts this time next year. Already one of the industry’s titans, John Malone, gave up his title as chairman of Liberty Media on New Year’s Day.

For Wall Street, these aren’t gossip items. They’re clear signals that a generational reset is finally underway.

As such, Wall Street is focused on “are you exiting or monetizing?” says Chris Marangi, a veteran media investor at Mario Gabelli’s Gamco, who dubs 2026 the year of “rationalization, re-aggregation and recoupling” after a decade of new streaming services and new companies flooding the market.

“Now is the time to get serious about who can grow, who has a future,” he tells me, noting that Netflix’s market cap at $400 billion is now almost bigger than all of the traditional media companies combined: Disney ($205 billion), Comcast ($109.2 billion), Fox ($30.6 billion) and WBD ($71.3 billion).

For investors, that gap isn’t just a curiosity. It’s a verdict.

The coming reset got its first real stress test this week. With Comcast’s cable spinoff, Versant, debuting on the Nasdaq today, investors got a look at how public markets are valuing legacy cable assets in 2026 — and it was brutal: Versant closed its first day of trading roughly 13 percent below its opening price of $45 a share.

The implications go well beyond Versant parent Comcast — especially with Warner Bros. Discovery preparing its own cable spinoff later this year, and as Wall Street quietly re-prices the entire linear TV ecosystem.

I spoke to Gamco’s Marangi, Integrated Media chief Jon Miller, Magid’s Mike Bloxham, Madison & Wall’s Brian Wieser and TD Cowen managing director Doug Creutz and more about what comes next for Hollywood — and who may end up owning it.

On Wall Street’s first full day back, yes, investors delivered an early judgment. And here’s what they’re watching next:

Why Wall Street is deeply skeptical of a Netflix acquisition of Warner Bros. Discovery — and what that skepticism really signals about Netflix’s own growth story

Whether any bidder for WBD can realistically clear U.S. and European regulators — and why some investors think the deal drags into 2027

What Versant’s rough first day on the Nasdaq revealed about how markets now value cable — and why it matters for WBD, Disney and Comcast

The case one top investor makes for Comcast to shed NBCUniversal entirely

How exploding sports rights fees are forcing new ownership models for leagues, teams and networks

Why AI companies, family offices — and even the U.S. government — are being quietly discussed as the next wave of media buyers

This article is for paid subscribers only. Interested in a group sub for your team or company? Click here.

For full access and to continue reading all Ankler content, paid subscribers can click here.