TV Sports Surge: Lawyers, Execs & Managers Get Ready to Rumble

Kevin Yorn says it's about an 'immediate internal rate of return' as Apple, Amazon and Netflix start moving even faster on rights (and Netflix fixates on one word)

Ashley Cullins writes about agents, lawyers and dealmakers for paid subscribers every other week. She recently covered the New Rules of Film Finance; the Pixar of AI signing up stars; and The Death of Cost-Plus Deals: Now What?. You can reach her at ashley@theankler.com

If there’s an underlying message to Hollywood from 2024’s dealscape it’s that the future is global — and that future is here.

In my last newsletter, I looked at the four pacts top execs, lawyers, managers and agents flagged as emblematic of larger industry trends: Legendary buying back Wanda’s stake in the studio with an eye on M&A, IP and AI; Disney reaching for new audiences with Epic Games; Walmart going after the TV advertising ecosystem via Vizio; and Comcast doing its own cord-cutting by spinning off cable assets.

While opinions were split on which individual deal last year was the most significant, there was consensus on a larger trend that everyone needs to be watching: Streamers’ unexpected but also unsurprising push into live sports via the NBA broadcasting rights bonanza and Netflix shopping spree. “The name of the game is immediate internal rate of return,” says Kevin Yorn, founder of Yorn Levine and entertainment-based private equity firm Broadlight Capital, referring to the financial analysis used to estimate the profitability of an investment. “The answer to profitability is much more known in live events.”

That’s proving to be true even with out-of-the-box live events, such as Netflix’s boxing match between Jake Paul and Mike Tyson that drew 60 million viewers — which CAA Sports co-head Mike “Vino” Levine told me in a wide-ranging December Q&A is a bullish harbinger because it shows “on a night-by-night basis [sports] is the last bastion of must-see reality television.”

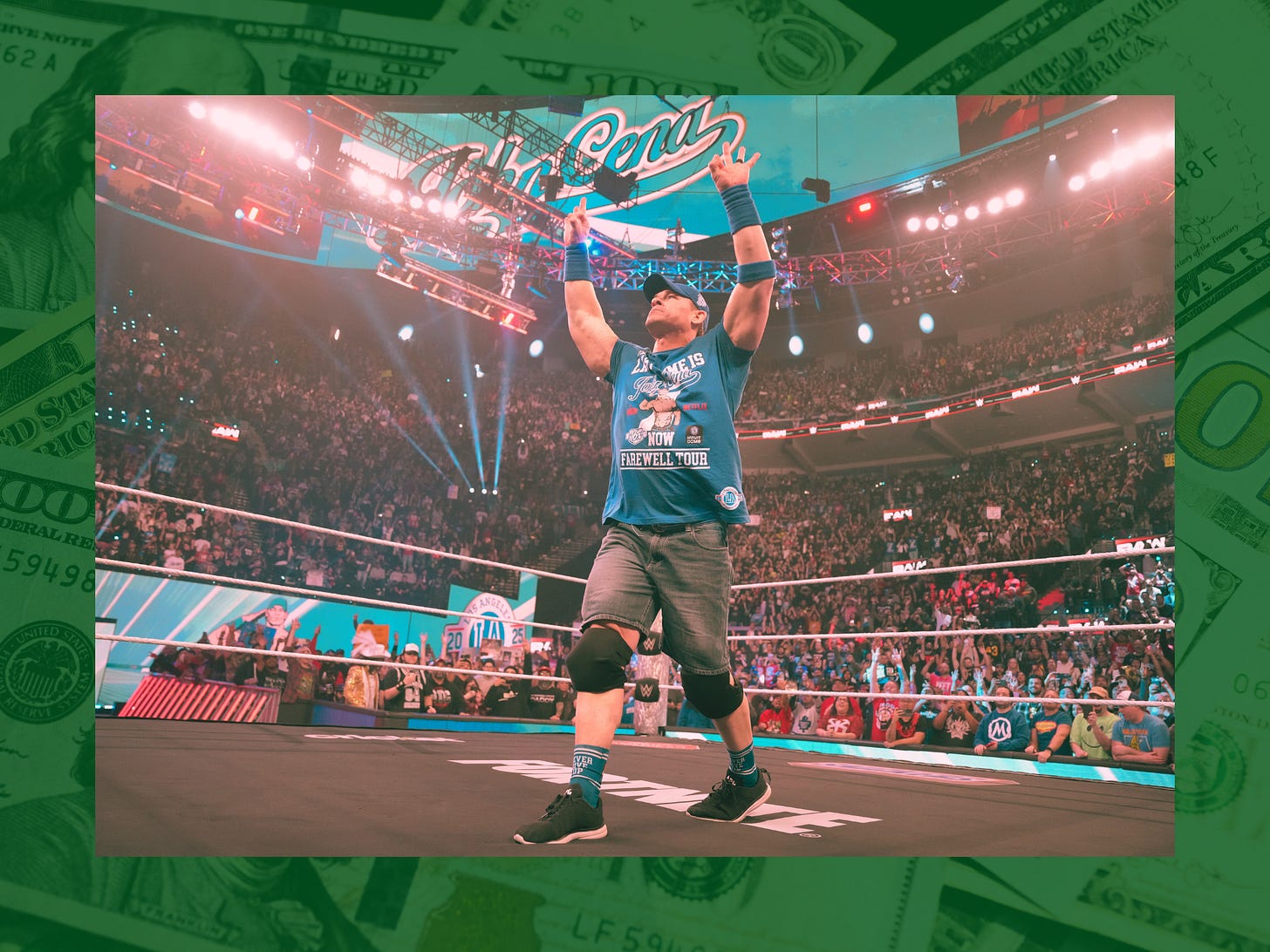

All of this means we’re seeing a shift toward deals outside of film and television — like Netflix’s $5 billion, 10-year deal with WWE, which premiered its first live Raw event last night. “There is a greater amp up of live entertainment,” Yorn says, “including traditional sports like the new NBA deal, women’s soccer and basketball and new sports models.”

Jon Liebman, co-CEO of Brillstein Entertainment, echoes the sentiment. “Those deals collectively are a big deal,” he says. “Streaming services are becoming places where there is appointment viewing. That reflects the decline of broadcast and cable and the willingness on the part of the streamers to spend on live to get people to watch something at the same time that has urgency around it.”

One official business day into 2025 only further validated that thesis with Monday’s Disney-Fubo deal, bolstering Hulu + Live TV with the sports-centric service, reinforcing the importance of streaming live sports — and solving an antitrust lawsuit that was a distraction at best for Disney. “There will be a few winners in the OTT/MVPD space,” says Jon Miller, CEO of Integrated Media, which specializes in digital media investments. He believes this is a sign that the consolidation many predicted is happening and will continue. “They will combine entertainment and sports offerings, in many ways mirroring the traditional pay-TV bundle.”

I spoke with agents, managers, lawyers and execs from companies including Netflix and Sheppard Mullin about what these deals reveal about streamers’ priorities and how that fits into the big picture for Hollywood.

In this issue, you’ll learn:

Why streamers’ push into live sports will be a net positive for the industry, including scripted and unscripted

The one word dealmakers believe is key to Netflix’s live sports strategy

How this strategy is influencing sports-related programming Netflix buys

Why the ad tier has more to do with it than you think

Why Amazon is simultaneously pursuing global and local sports rights

What Apple’s MLS rights portend for all streaming sports deals

Why Amazon and Disney will be the most important players as new rights come up

The most underrated element of the NBA rights deal — and how it may upend programming schedules

So What Exactly is Netflix Doing?

This column is for paid subscribers only. Interested in a group sub for your team or company? Click here.

For full access and to continue reading all Ankler content, paid subscribers can click here.