Timothée Chalamet’s ‘Marty Supreme’ Wheaties Sold Out. What That Says About Fandom Today

Merch is on fire even as movies and box office struggle

I write Crowd Pleaser from Ankler and Letterboxd that covers audience and moviegoing trends. I wrote about small-town theaters fighting against studios, scooped how Paul Thomas Anderson landed in Fortnite and drove across 20 states to visit 58 U.S. theaters. Email me at matthew@theankler.com

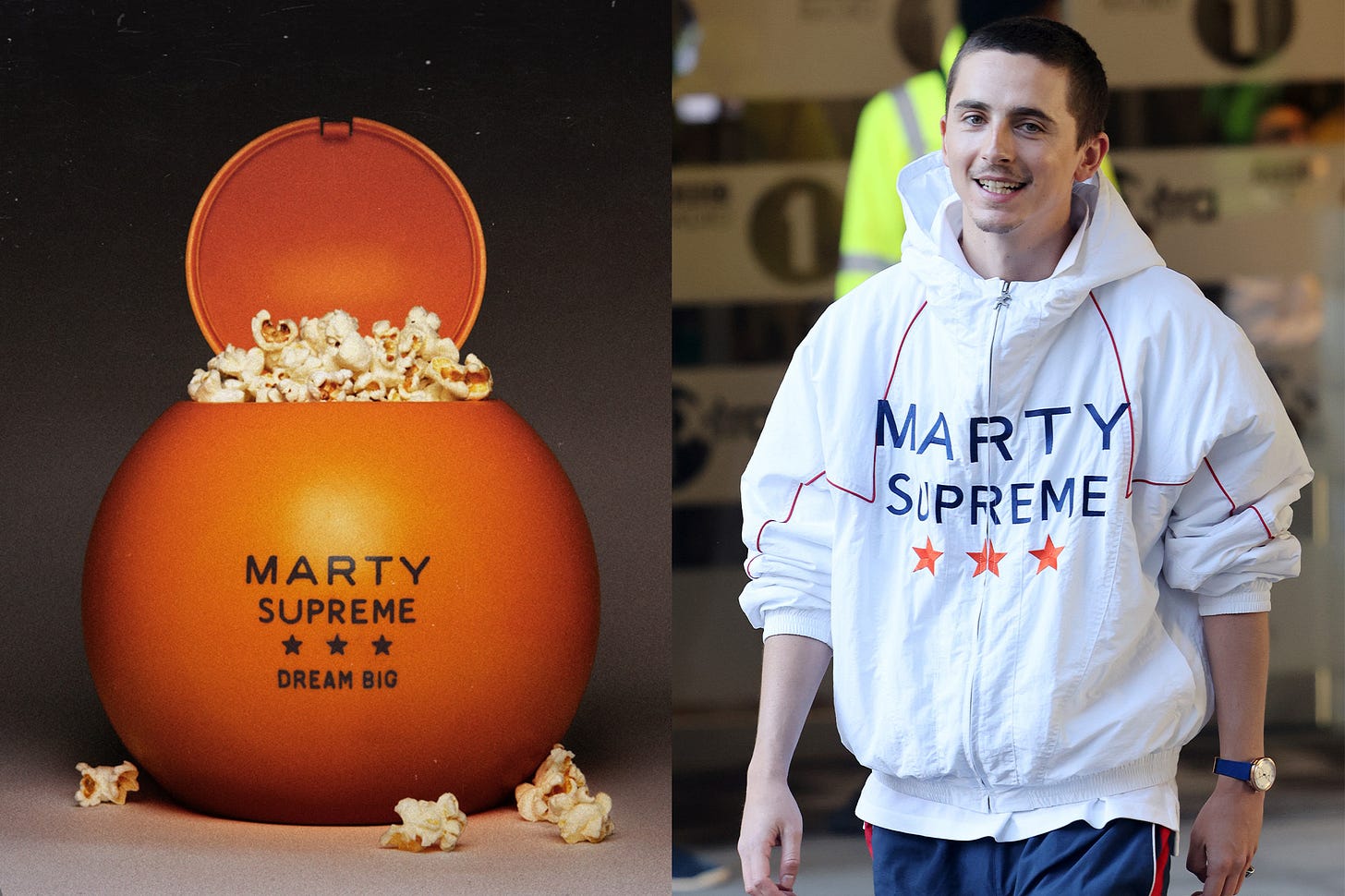

Earlier this month, A24 sold out of a $25 box of Marty Supreme–branded Wheaties — a novelty item tied to Timothée Chalamet’s fictional table-tennis phenom — in a matter of hours.

That might not sound remarkable until you consider that a standard box of Wheaties typically retails for under $6, and that the movie itself had yet to reach a wide audience. But the cereal wasn’t really the product. It was a signal — one that fans immediately recognized and raced to claim.

In the weeks leading up to the film’s release, Marty Supreme merch had already become an obsession online. Fans waited in long lines at pop-up shops in New York and Los Angeles to buy $250 windbreakers emblazoned with the film’s title. Secondary-market prices for the jackets quickly soared into four figures. When A24 partnered with Regal on a custom Marty Supreme popcorn bucket — a giant orange ping-pong ball available to Regal Crown Club members who purchased advance tickets — it was less a concession item than a badge of belonging.

The Wheaties box, in particular, was a reference to an inside joke from the film itself, in which Marty assures a potential business partner that his future success is so inevitable that he’ll one day be “staring at him from the cover of a Wheaties box.” By turning that line into a physical object, A24 wasn’t just selling merchandise — it was collapsing the distance between the movie, the marketing and the fan experience.

That kind of physical-world urgency has become especially potent for Gen Z.

“I know I’m absolutely gonna love it, so that’s why I bought it,” wrote one fan on Reddit. “When it inevitably sells out, I’m gonna wanna buy it on eBay when the price probably skyrockets.”

To understand why moments like this now matter as much as — or more than — opening weekend, I spoke with the five consumer-products chiefs from Warner Bros., Universal, Paramount, Sony, Lionsgate, along with licensing executives and fan-creators operating in Hollywood’s increasingly porous merch ecosystem.

The Marty Supreme frenzy is less a one-off curiosity than a sign of how today’s blink-and-you-miss-it hype machine works. With the box office under strain, and competition for attention more brutal than ever, merch is a fast, social-first way for studios to tap into rabid fan enthusiasm — and, increasingly, to follow it.

“You’re always aiming for two things,” says Bruno Maglione, president of IMG Licensing, which has overseen campaigns for properties including Fast & Furious and Gabby’s Dollhouse. Revenue, of course, still matters. “But the other utility,” Maglione says, “is serving as a marketing vehicle. Anything that can help to put you into the zeitgeist is going to be useful.”

In other words, in today’s Hollywood, a sold-out cereal box can say more about a movie’s cultural footprint than its opening-weekend gross ever could.

When Fans Lead the Market

That shift quietly is reordering Hollywood’s merch economy. As studios chase signals like the Marty Supreme sell-out, fans have become the industry’s earliest — and most accurate — market testers, surfacing demand long before anything is officially licensed or mass-produced.

Andrew Ortiz founded Super Yaki a decade ago to serve what he describes as “AMC A-Listers and Letterboxd users” — moviegoers who want merchandise that references a film without simply slapping its title on a hoodie. The appeal is subtle: items that function as an inside joke for people who’ve actually seen the movie (or at least watched the clips and trailer).

That sensibility clicked in a big way with Challengers, the Amazon MGM tennis drama starring Zendaya, Josh O’Connor and Mike Faist. Ortiz designed a “New Rochelle Challenger” T-shirt, a reference to the central event that binds the film’s thorny throuple. Unsure how the studio would react, he emailed a contact at MGM asking whether it was okay to sell the shirt.

“Well, we’re not going to say anything if you do it,” the representative replied — effectively giving him the green light.

“We were sort of promoting the movie for them at that point,” Ortiz says. The shirt quickly became Super Yaki’s best-seller, with thousands of orders pouring in — so many that Ortiz had to rent a U-Haul to transport inventory.

That dynamic — fans identifying demand, studios quietly tolerating it, and success proving the market exists — is increasingly common. But it has also prompted studios to absorb those strategies themselves. Indie distributors, including A24 and Neon, have begun bringing the “if you know, you know” aesthetic in-house, hiring designers to create trend-forward merchandise rather than outsourcing that work to independent creators.

The shift forced Ortiz to adapt. Super Yaki now focuses less on studio-specific IP and more on celebrating moviegoing itself, often partnering directly with independent theaters instead of relying on studio properties. “We had to pivot,” he says. “The studios caught up.”

USC professor Henry Jenkins, who studies media and participatory culture, says the cycle is familiar.

“The fans are usually first to market,” Jenkins says. “That’s where the sense of edging the fan craftsman out — and profiteering off of their risk and success — becomes more of an issue.”

Still, Jenkins notes, studios face their own realities. They have a legal and financial responsibility to control and monetize their intellectual property. The challenge is finding a middle ground that acknowledges fan labor without stifling it entirely.

“We’re seeing some efforts now to reward fan labor through revenue sharing or publicity for the creative work fans have done,” says Jenkins. “That’s where some of the best practices are emerging.”

How Studios Are Leaning In

Nick Micheels, a 33-year-old school administrative assistant and freelance drummer, rediscovered LEGO during the pandemic, designing concepts in digital studio software. At the same time, he and his wife began an ironic Twilight viewing habit that eventually morphed into genuine affection for the franchise. So, Nick combined his two new passions and spent a couple of hours every couple of nights for a month creating a LEGO Twilight set.

“It definitely was an ironic idea to start with,” Nick says. “I just thought it would be really funny as a LEGO movie.”

He submitted the design to LEGO Ideas, a platform where fans upload design ideas for new LEGO sets. The project hit 10,000 likes in just over 24 hours, making it one of the fastest sets to reach that milestone, prompting the LEGO team to review and eventually approve the design. Lionsgate became involved, IMG Licensing helped negotiate a licensing agreement, and voilà — after a year of monthly meetings with LEGO designers and Lionsgate representatives to refine the product — Nick’s design went on shelves.

“It was very surreal for that to happen. It took some processing just to kind of get through that high,” he says. “LEGO’s team did a good job ultimately of striking the balance of giving fans something serious, and just letting the fact that it is LEGO be what makes it campy and fun and silly.”

As part of the arrangement, Nick receives a royalty of 1 percent of net sales — along with 10 complimentary copies of the set, which costs $219.99 and is available at multiple retailers like Target and Best Buy.

Nick knows that he’s the ideal version of this kind of story. But there are others, too. FanWraps co-founder Nick Murray, whose site specializes in vehicle wraps and car accessories for brands like Star Wars and Fallout, began his journey as an original member of the “R2 Builders Group,” a fan community dedicated to building replica R2-D2 droids. After applying to Lucasfilm for a license to use Star Wars iconography on car graphics, he was approved, and FanWraps was born.

His biggest issue now: other fans. “It’s frustrating,” says Murray, who was undercut on his popular “Child on Board” decal featuring The Mandalorian’s Grogu (the actual name of the character most refer to simply as “Baby Yoda”) by a variety of unofficial knockoffs. “To go through the proper channels, do costly safety testing, only to have people circumvent it and undercut you. That’s definitely caused some disappointment, trying to do everything by the book.”

Let’s Take a Studio Tour…

The whole ecosystem is quite complex — fans deploying IP from studios, studios taking from fans’ creations, and those same fans being taken advantage of by other fans. But for the studios, often at the center of these situations, it all fits into the larger fold: their outsized consumer products units.

Below, I talked to five studio consumer product heads, who told me how they’re adapting to the new marketplace — one where grownups (or “kidults,” as one executive calls them) are demanding attention.

Lionsgate: Incorporating the Fans

“We’ve had closer connectivity to our fans now than we’ve ever had before, and that is so much better for them, and for us,” Jenefer Brown, Lionsgate’s president of global products & experiences, says.

Part of what that means, in Lionsgate’s case, is monitoring social media and other channels for audience trends. Fall’s “hoa hoa hoa” season, a fan-led phenomenon that serves as a reference to a song from the Twilight soundtrack, fueled themed merchandise and a fall collection. Likewise, a recent Crocs x Twilight collaboration emerged because fans posted online about wanting it after spotting a different IP’s Crocs collaboration.

The other aspect is actually licensing fan creations (like the Twilight LEGO set). Lionsgate also cut a deal with a fan who knitted a replica of the “shrug” Katniss Everdeen wore in The Hunger Games and sold her design specifically. “Fans have more ways to reach us,” Brown says.

Best-sellers: “Twilight … The Hunger Games, John Wick. Horror is really big, especially the Saw franchise,” Brown says. Nostalgia titles also perform well, with Dirty Dancing remaining a fan favorite and Mad Men seeing a resurgence ahead of its 20th anniversary.

Sony: Speeding Up the (Digital) Shelves

Jamie Stevens, Sony’s EVP of global consumer products and licensing, says speed has become increasingly important to “meet fans where they are.” The business split is still roughly 60 to 70 percent traditional retail, but the remainder — non-traditional or digital sources (like TikTok Shop) — has been a source of innovation.

While traditional retail domains like toys still require lead times of 12-18 months, print-on-demand and digital storefronts get products to market in “a matter of weeks or days,” Stevens says. Take Vince Gilligan’s recent Apple TV hit Pluribus, a Sony television production. As the series soared to become the platform’s most-watched show ever, Sony quickly set up shop on the Sony Pictures website.

“Wherever fans are, we meet them,” Stevens attests. “If it’s traditional retail, we have products there. If it’s on TikTok shop, if it’s online, we’re really much more focused on being nimble and being able to reach fans wherever they are.”

Best-sellers: Ghostbusters stands strong as Sony’s crown jewel. “That is an evergreen property for us,” Stevens says, “both the original movie and then all of the iterations of the franchise.” Other top performers include Hotel Transylvania, Jumanji, The Boys and Breaking Bad.

WB: Value of Long Leads

Like other studios, Warner Bros. has been keen on speeding up parts of its consumer products arsenal. When season three of The White Lotus took off, it quickly jumped into luxury collaborations with Bloomingdale’s and CB2. After Sinners became a hit back in the spring, the team rushed to ensure the film would become a Halloween staple.

But that’s still just 20 percent of the business.

The other 80 percent — long lead time, planned out years in advance — pays exceptionally high dividends for a studio with a library and catalog like Warner Bros.

“We’re sitting here on Dec. 17, which means yesterday was Dec. 16, and we delivered all of our spring/summer 2027 creative guides,” WBD global head of consumer products Robert Oberschelp says. He notes that he and his team are already in “lockstep” with DC Studios head and Man of Tomorrow director James Gunn on the creative behind the summer 2027 Superman sequel.

A significant focus of that foundation for WBD is seasonal. For Harry Potter, it means hitting different “beats” throughout the year, which includes “Butterbeer Season” in the spring, “Back to Hogwarts” at the end of summer and “Dark Arts” during Halloween (though Oberschelp has pushed horror — from IT to Beetlejuice — from just a Halloween play to year-round). And as the owners of Elf, which was distributed by Warner Bros. subsidiary New Line Cinema in 2003, the Christmas season is particularly fruitful, with this go-around prompting “December the TwELFth” (get it?) to become a retail event in addition to the film’s theatrical re-release.

Best-sellers: Not surprisingly, Harry Potter is the top-tier franchise that drives the business. The DC Comics universe and classic animation (Looney Tunes and Tom & Jerry) also serve as core pillars. “Those really are kind of the evergreen ones,” Oberschelp says.

Universal: The Parks Upper Hand

Universal has one big advantage when it comes to consumer products: its parks (the newest of which, Epic Universe in Orlando, debuted this year and marks the first one opened in the U.S. in over 20 years).

“It’s a highly lucrative business inside the park because we’re a vertical business,” Vince Klaseus, president of products and experiences at Universal, says. While Universal maintains a robust licensing business like other studios, its parks merchandise operates vertically, meaning Universal handles every part of the process internally — and sells to a “captured audience,” as Klaseus puts it.

The two sides of the business — licensing and parks — maintain a symbiotic relationship, with insights from the parks informing broader retail strategies. In contrast, developments from the licensing market are brought back to the parks. “It does flow back and forth very nicely,” Klaseus says.

Best-sellers: As the Jurassic World franchise undergoes a Rebirth, so too has Universal’s product line around the franchise, bolstered by the new entry over the summer. For a younger crowd, “Gabby's Dollhouse has really been a fantastic preschool play for us,” Klaseus says, with the film this year sparking “a huge jump internationally.”

Paramount: ‘Brand Deposits’

For Mattel and Marvel alum Josh Silverman, who joined Paramount in October as president of global products and experiences, the core philosophy around the business is to create “brand deposits” — products that deepen fans’ emotional connection to the franchise and add value to the IP — rather than “brand withdrawals” that merely extract revenue.

“We want to be really careful and really thoughtful about the things that we put into the world,” Silverman says.

His hope for a brand that can regain stealth-merchandising relevance: MTV. “I’m really intrigued by MTV,” he says. “Before I joined, they’ve done some really cool things with logos and callbacks, but the MTV portfolio is incredibly cool. Having grown up with it, maybe it’s my connection to something, but I think there’s something there.”

Best-sellers: “Big is contextual,” Silverman points out, but the biggest money-makers for Paramount come from its evergreen kids properties: Paw Patrol, Teenage Mutant Ninja Turtles, SpongeBob SquarePants and Avatar: The Last Airbender. Elsewhere, Star Trek drums up interest among young and old fans alike, while classics like The Godfather and Top Gun stay relevant.

Now From Letterboxd: Physical Media Returns

A how-to guide to maximize your collection

While it may seem like every movie is available thanks to streaming, the landscape that has emerged is essentially one where titles tend to bounce between services, so you can never be 100 percent confident the movie you want to see is on a streamer you use. There’s also the option of digital rentals, but the more obscure the movie, the harder it is to procure.

Thankfully, the physical media market has stepped up to fill the gap with boutique labels like Second Sight, Severin and Vinegar Syndrome joining larger players such as Criterion, Shout and Arrow. At Letterboxd, at least, we feel there’s never been a better time to be a collector of films that never received their due upon theatrical release or even on VHS and DVD.

But what should you do once you have all these discs in your home? You’ve shelved them, but perhaps made the mistake of re-buying something you already own (this is how one might end up having two copies of The Hudsucker Proxy — just saying from experience!). It’s not the worst problem to have, but some organization is in order. That’s where Letterboxd is stepping up to help you keep track of your collection. Pro and Patron members can utilize the “own” or “owned” tags on their movies (and lists), and then when you search for a film, it will add your physical version to the streaming options provided by JustWatch. Those categories can be broken down even further, if you like, from owned to subcategories like Blu-ray or 4K, as Letterboxd’s Head of Editorial, Mitchell Beaupre, did with their collection. You can also shout out your local video rental stores by tagging your rentals like I do whenever I rent from Atlanta’s Videodrome. Ella Kemp recently ran down many more ways you can use Letterboxd to better keep track of the movies you own and amplify your physical media habits.

Once you’ve got your collection set on Letterboxd, always keep an eye out for the latest editions of Katie Rife’s monthly Shelf Life feature, which will point out notable movies arriving on disc. Digital rentals can also be a great way to discover movies, like in Letterboxd’s new Video Store, but once you find a film you love, make sure you add it to your collection. — Matt Goldberg for Letterboxd