Tariff Terror: TV Production Braces for Trump-Induced Sticker Shock

Lumber for sets is just the start. How budgets will crunch prop masters and in turn scripts: 'We're going to see impacts we're not even prepared for'

Elaine Low reports on TV from L.A. She recently interviewed WME digital strategy head Chris Jacquemin and leading animators about Hollywood’s cautious embrace of AI and wrote about the rise of executive coaching in the entertainment industry.

Hello from Las Vegas, where most of the Ankler gang and I have been moderating panels for our Business of Entertainment partnership with NAB Show, and were up late at a good vibes VIP dinner hosted by Janice Min, Karen Chupka, Jane Rosenthal, Lesli Linka Glatter and Jody Gerson last night at Hakkasan, sponsored by IW Group. If you happen to be here today, come watch my onstage chat with RuPaul’s Drag Race exec producers Fenton Bailey and Randy Barbato, followed by a panel on the main stage with top nonscripted execs Andrew Fried, Jen O’Connell, Howard Owens and Courtney White. Sean McNulty, who’s been in Vegas since the start of CinemaCon and I assume now lives here, is chatting with Tom Staggs on stage this morning — and WWE president Nick Khan and chief content officer Paul “Triple H” Levesque on Wednesday — but Janice is first up in conversation with Jody at 10 a.m.

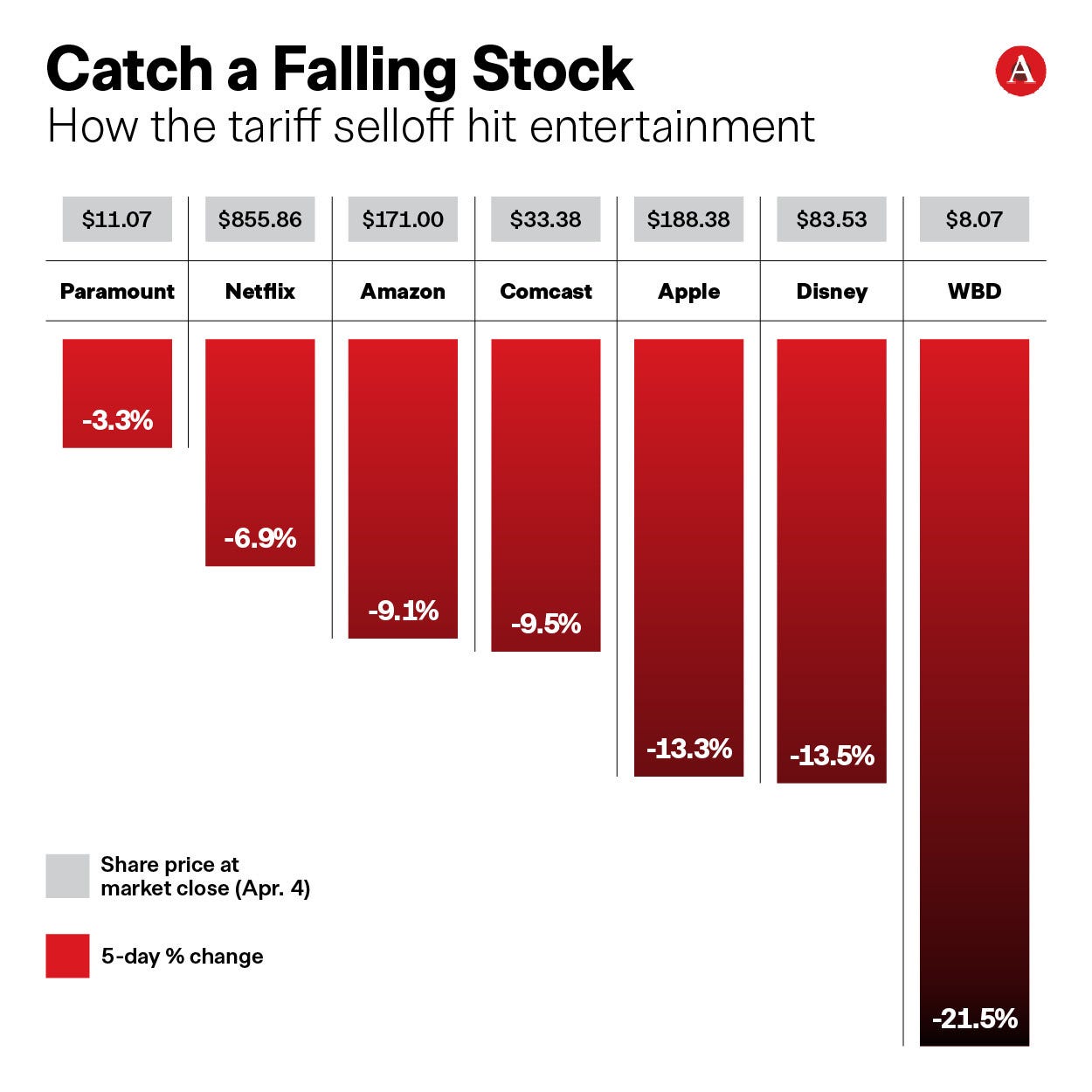

We’re here at NAB to discuss entertainment, but seems like all anyone wants to talk about right now is President Trump’s imposition of tariffs that have sent the stock market into a tailspin. The stocks of the major TV studios, networks and streamers were all down last week:

Amazon and Apple have the most exposure to the tariff policy because they largely sell physical goods that are made overseas. Disney and Comcast do have meaningful licensed merchandise divisions, products that are overwhelmingly manufactured outside the United States, but they’re primarily services businesses, as is all of entertainment. Trump’s tariffs ignore the service economy entirely.

But the impact on the broader economy and the average consumer will affect the TV business in multiple ways. If companies getting taxed on imported goods decide to pass the bulk of those expenses onto consumers (which is likely), that will increase the cost of living — the cost of nearly everything. Big-ticket purchases that could get in under the wire of the tariffs taking effect could eat up budgets for more discretionary spending. One industry exec tells me he has several friends who dashed out to shop for a new car this past weekend before price hikes hit dealerships.

Every streamer has raised prices recently, most of them outpacing the rate of inflation. One can imagine people scrutinizing their entertainment budgets carefully with unemployment expected to rise and JPMorgan increasing its projected odds of a recession to 60 percent.

Streamers are increasingly reliant on their advertising tiers, which generate more revenue per user than subscription-only offerings, and advertising is expected to take a couple of knocks as brands almost always pull back their marketing spending during uncertain or recessionary times. This is, of course, crummy timing with Upfronts just over a month away, when every major entertainment company will be hawking their wares to Madison Avenue.

Although the stated goal of Trump’s policy is to encourage domestic manufacturing, Hollywood’s existing U.S. production does not appear as if it’ll benefit. In fact, the physical act of making television could get yet more expensive in the United States.

The tariff situation remains fluid, with the possibility of Trump delaying his plan or altering it at any moment, especially as world financial markets continue to absorb losses. But presuming the plan takes effect in some form or another, how will physical production most be affected?

To take the temperature of the situation, I reached out to a former head of physical production at a studio, the president of the Prop Masters Guild and the owner of the world’s largest prop house..

In this week’s Series Business, let’s unpack:

Which types of series are most likely to be affected

The production budget items most susceptible to tariffs

Where studios will pressure shows to cut to make up for other rising costs

How prop masters are preparing for the worst

The types of taken-for-granted products that can only be sourced internationally

How season planning may need to change to accommodate procurement

What local politicians at Sunday’s Stay in L.A. rally tell The Ankler about their hopes and fears

Why the uncertainty is the hardest part