Supermerger: Inside the Deal That Would Finally Give Netflix a Real Rival

Industry insiders reveal their excitement over David Ellison’s Paramount-WBD dream and a rebalance of power: ‘My enemy’s enemy is my friend’

I cover TV from L.A. I wrote about the 10 showrunners who define the TV market now, the Amazon TV mess as Peter Friedlander takes over, and Vince Gilligan’s overall renewal with Sony TV. Email me at lesley.goldberg@theankler.com

What would Paramount Skydance look like if it swallowed up Warner Bros. Discovery? And could that potential behemoth — combining franchises ranging from Harry Potter, Game of Thrones and DC Comics to Yellowstone, Star Trek and NCIS along with brands including HBO, CNN, Nickelodeon and BET — have enough scale to go head-to-head with Netflix?

Paramount Skydance CEO David Ellison — the son of billionaire Larry Ellison — continues to pursue a deal for the legendary studio after his $20- and $24-per-share bids for WBD were both rejected. Paramount is but one of “multiple” potential buyers for the storied studio as CEO David Zaslav confirmed Tuesday that Warner Bros. Discovery is officially for sale. Zaslav is open to selling off all of WBD, just its studios and streaming division or other mix-and-match alternatives. While WBD declined to name names, various reports have Netflix and Amazon as well as Comcast kicking the tires. (On Netflix’s quarterly earnings webcast yesterday, co-CEO Greg Peters downplayed the streamer’s interest in WBD, noting its history of “being builders rather than buyers.”)

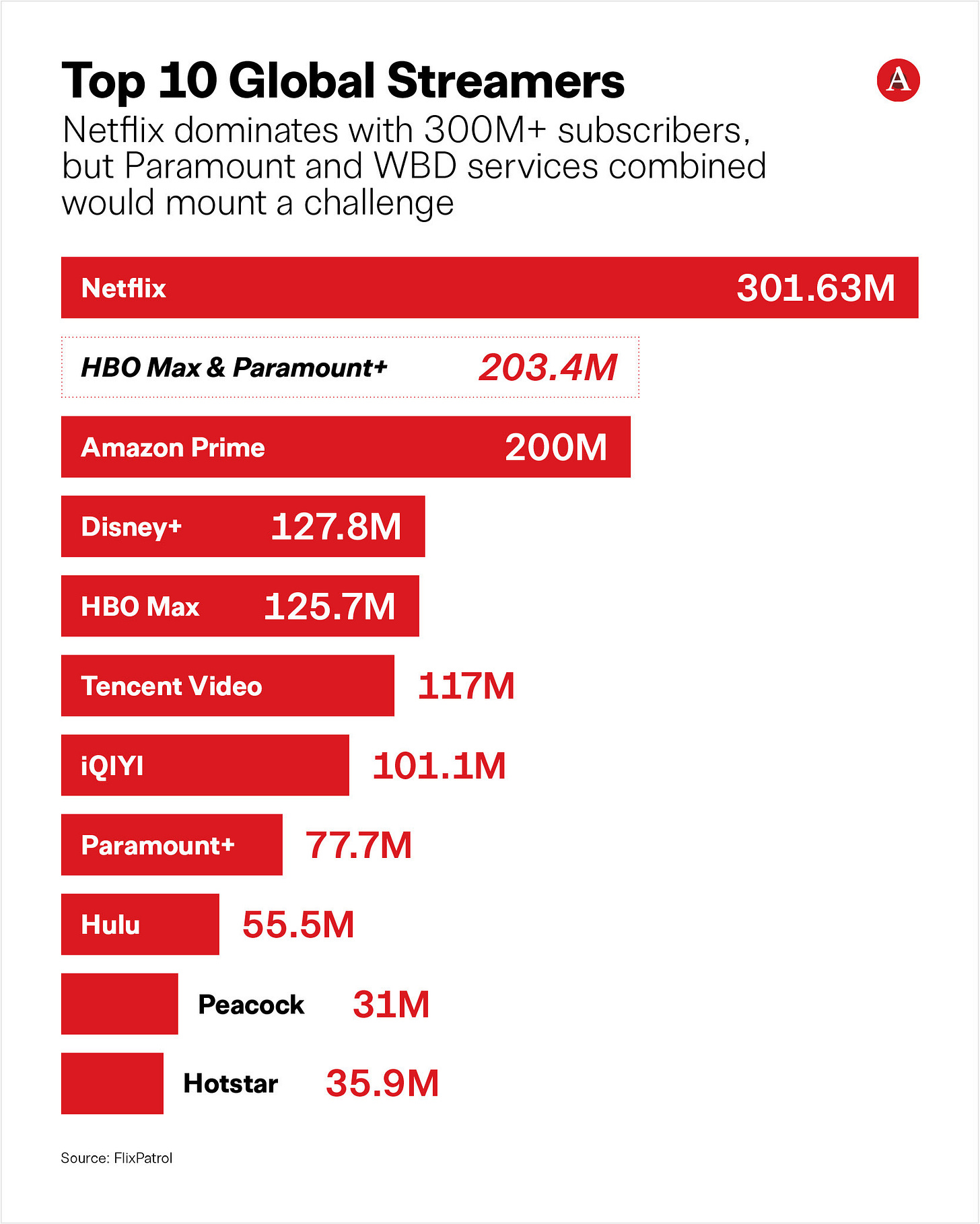

After conversations with scores of industry observers, one thing is clear: A combined Paramount Global and Warner Bros. Discovery actually could stack up against the industry dominance Netflix has built in the past decade. As Ankler CEO Janice Min said on CNBC yesterday, “not everyone can survive,” and she reiterated what many have presumed: that only four major streaming platforms are expected to come through to the other side, and that Ellison didn’t buy Paramount “only to own the 7th biggest streamer.” Indeed, a merged Paramount+ and HBO Max would leapfrog into second place in global subscribers — trailing only market leader Netflix.

Multiple sources, all of whom declined to speak on the record given their relationships and business with big Hollywood companies, compared a potential Paramount-Warners merger to the 2019 deal that saw Disney spend $71.3 billion to acquire Fox’s film and TV studios. While that pact saddled Disney with a pile of debt (thanks in part to Comcast’s Brian Roberts muscling in with his own bid for Fox that boosted the price), it’s a prime example of the kind of M&A needed to remain competitive in today’s marketplace. Disney-Fox had its skeptics, but the return on investment continues as the Mouse House now owns programming from onetime Fox hitmakers including Dan Fogelman (This Is Us, Paradise, Only Murders in the Building) and scores of valuable franchises including The Simpsons and Avatar.

On the other hand, such a merger raises red flags across the industry. My colleague Richard Rushfield sees danger ahead with an acquisition of WBD by Paramount or anyone else. The logic is understandable: Letting another legendary Hollywood studio get absorbed into a bigger conglomerate, Richard has argued, means less competition, fewer buyers, fewer companies making and distributing TV (and movies) and a faster march toward the end of the entertainment industry as we’ve known it.

Still, getting a few Hollywood heavies together to mount a real challenge to the industry’s big disrupter has its appeal across town. “The enemy of my enemy is my friend,” one high-level source says with a laugh when asked about a Paramount-Warners mashup vs. Netflix.

So what would a company led by executives including Paramount’s Jeff Shell and Cindy Holland and Warners’ Casey Bloys and Channing Dungey look like, and what could Hollywood expect from such a massive rollup?

In today’s newsletter:

Why Warners is the ultimate prize for Paramount — and I name the other suitors circling

Why one insider says it’s “irresponsible” for the deep-pocketed Ellison not to scale up

How Warners’ true “Tiffany network” (hint: not CBS) could make Paramount an instant streaming player

How a murderers’ row of Paramount and WBTV writers stacks up against Netflix’s exclusive roster

What insiders expect Ellison to do with all those cable networks — “There has to be a strategy”

Who’d come out ahead in the inevitable executive shuffle

And the fallout to come: fewer studios, and “there will have to be cutbacks”

This column is for paid subscribers only. Interested in a group sub for your team or company? Click here.

For full access and to continue reading all Ankler content, paid subscribers can click here.