This Assistant Director Made $7,000 Last Year

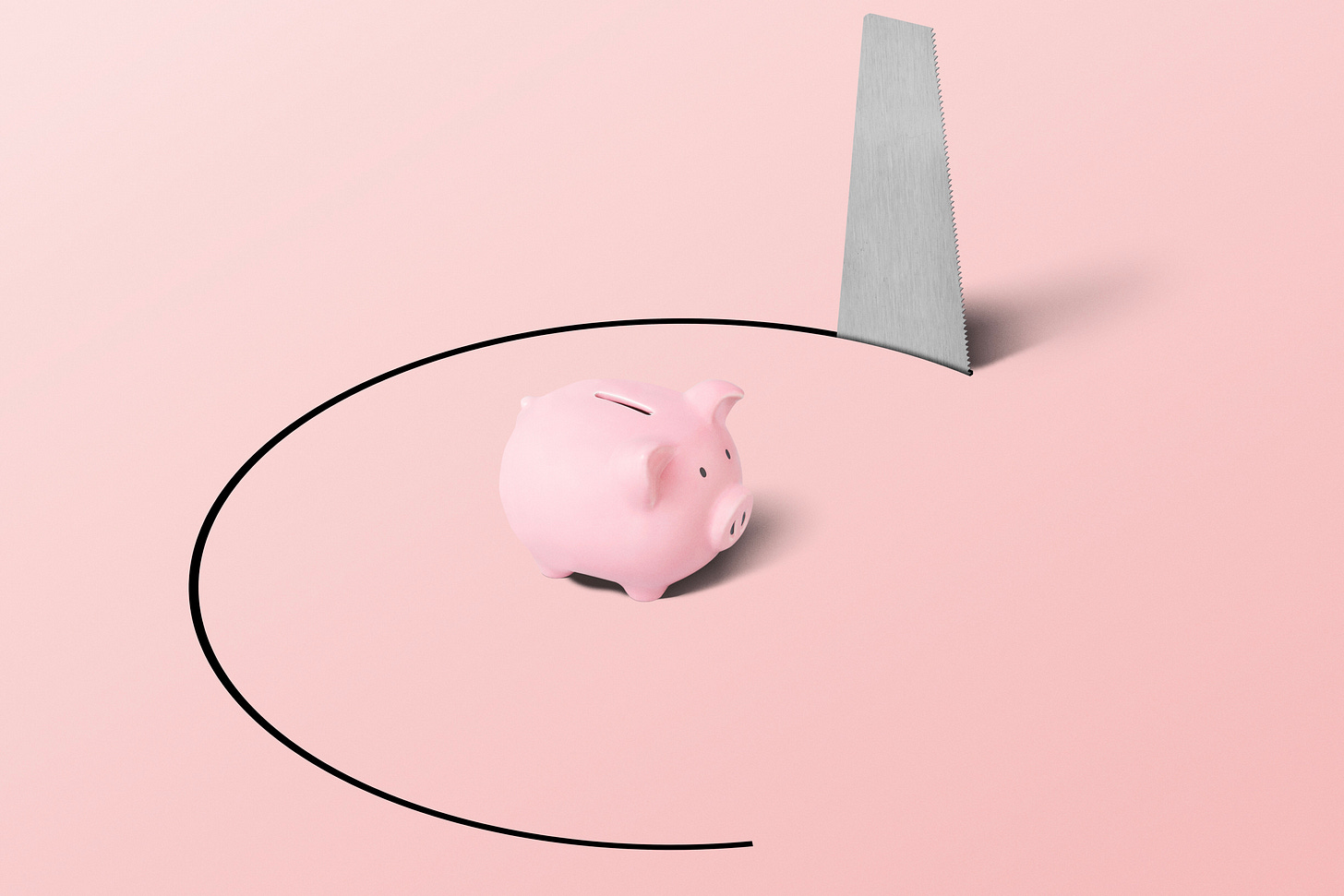

Gone? Orangetheory, therapy, a car. In the latest Salary Confessions, 'The work I put in feels like a wasted decade'

Happy Fourth of July week, Series Business readers. Some people have been saying this is the summer of “no vacations,” but color me skeptical. Who among you are out of office this week — but still reading The Ankler, of course — and to where? How do you summer in the age of austerity?

News of the IATSE deal with the studios last week no doubt provided the town some relief ahead of the holiday. A summary of the new Basic Agreement dropped over the weekend, featuring wage increases, pension and health plan contributions, and new parameters around the use of artificial intelligence.

Some of those AI guidelines include: “established clear and comprehensive definitions for AI technology,” the development of work training programs that offer AI system skills training, the right for union members to request consultations with producers about the use of AI in a project — and “clear and conspicuous” written requests for consent from producers to scan an employee.

Of course, the Hollywood Teamsters and Basic Crafts are still in the middle of talks with the studios over their contracts, so no deep exhales just yet.

Crew members: How are you feeling about the new IATSE contracts? Write me at elaine@theankler.com and let me know if I can publish your response.

This week, we’ve got another Salary Confession. Dozens and dozens of you have written in to share how life and work are going, and I’m beginning to see a pattern — things are grim, there is no going back to whatever normal was, and yet . . . you have hope. Not a blazing beacon of hope, but enough of a glimmer to stay in the game. (Anyone who would like to share their story with me can do so via this Google Form. As always, your anonymity is guaranteed.)

Today’s spotlight is on a 33-year-old assistant director who lives in Manhattan with his wife and baby. When he was working regularly, he was earning between $90,000 and $130,000 annually. But work has slowed to a trickle since the strikes, turning his family into an unintentional single-income household. Though his wife makes more than $200,000 a year as a financial analyst, the cost of living in New York quickly eats away at their savings.

“I feel like kind of a shitty husband, where she’s got this great job and yet she had to give up therapy because we can’t afford it — just small things that we’re sacrificing,” he told me by phone over the weekend. “You think: stable, good-salary job, could at least get by [but] after rent and daycare and student loans . . . it goes really fast.”

Today, he breaks down in detail his expenses (food, rent, child care), his resume, being on the brink of losing his DGA health insurance, and what he, his wife and baby have had to give up.

This column is for paid subscribers only. For full access and to continue reading all Ankler content, paid subscribers can click here.