‘NOT GOOD’: Agents’ Alarm as Netflix-WBD Stokes Panic, Fears of a Market Pause

Reps on what they're telling clients, mounting questions and a possible bright side: ‘Where there’s chaos, there’s opportunity’

I write about TV from L.A. Fill out my end-of-year survey and tell me what you predict for your own career and the future of the entertainment industry. Especially after the latest merger news, I’m sure you all have thoughts…

Now that the occupation of the Albanian army is marching forward, with Netflix emerging as the surprise winner in the war for Warner Bros., people in the business of television are scrambling to figure out what it means that a former rental-DVD-by-mail company is now officially poised to (metaphorically? literally?) stamp a big red N on the iconic Warner Bros. water tower. And yes, in case your head hadn’t stopped spinning from Friday, we all woke up today to news of Paramount’s hostile bid for Warner Bros. Discovery. So let’s not presume this story is over — but for now, everyone in town is still digesting Netflix’s $82.7 billion bid to swallow up Warner Bros.

“Omg!!!! I mean… it’s awful, right?” one high-powered TV lit agent at one of the Big Three agencies texted me Friday morning as the news landed. Messaged a senior TV development exec: “It feels really existentially dreadful. Everyone I’ve texted with in the last 12 hours has been scared, tbh.”

“NOT GOOD,” said an email from a senior TV lit agent at a separate firm.

Netflix is still basically synonymous with TV in 2025. Even as YouTube has encroached on living room viewing, for American consumers, the streamer is a staple household product; for Hollywood’s workforce, it’s a deep-pocketed big spender that helps to keep many lights on. So the outrage might at first appear counterintuitive. Netflix isn’t the first tech titan to open its maw and swallow a hallowed film or TV studio, yet Amazon’s deal to buy MGM didn’t generate nearly this much fear or outrage. (Granted the scale of WBD dwarfs MGM.)

The sense of shock seems to percolate from a subtextual sentiment. You already won the Streaming Wars, Netflix. You drove up premiums for creators and powered the Peak TV boom and bust as other streamers vied to be No. 2. Now you’ve got to go and absorb one of the last bastions of Old Hollywood too?

Don’t you have enough?

“Warners is a legacy studio — 100 years of history — and it’s being gobbled up by a tech company, and it’s just kind of indicative of all the things we’ve been through,” the second agent later laments by phone. “There was something really enchanting and romantic there. There was something special about these legacy studios.”

Related:

A Paramount-WBD deal would leave a bad taste in the mouths of many, given PSKY chief David Ellison’s chumminess with President Trump, but at least it would create a legit competitor to Netflix. The Netflix-Warner Bros. coupling instead pairs the dominant streamer with a storied TV studio that supplies much of the market with shows (not to mention the ultimate prestige programming brand, HBO). Disney is arguably the only other well-rounded heavyweight left.

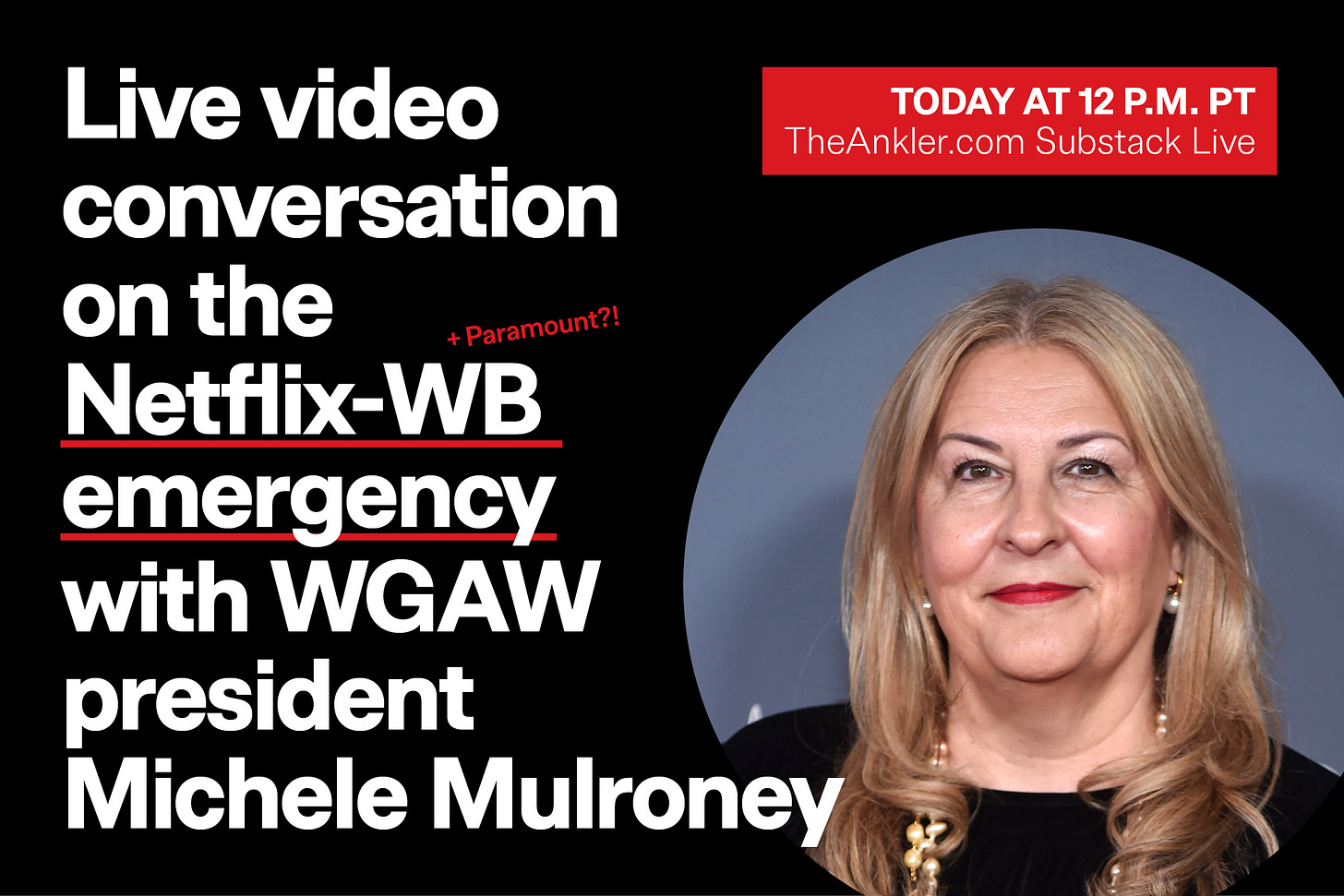

For more on what all of this means, today, Dec. 8, WGA West President Michele Mulroney will join me on Substack Live at 12 p.m. PT to discuss the impact of a Netflix acquisition of Warner Bros. and why the guild believes the merger should be blocked. Join us and join in to this interactive chat — we want to hear your ideas and questions.

Now, on to today’s column. I spoke to several high-ranking TV lit agents — the folks who have a 30,000-foot view of the market — to get their sense of:

Agents’ most urgent concern about the Netflix-Warner Bros. tie-up

What development and the programming market will look like with one less buyer

Netflix’s singular power as its dominance drove the spendy years of Peak TV, and “now they can drive it the other way”

Short-term security for HBO’s premiere brand (and long-term skepticism: “Do we believe they really keep HBO and HBO Max?”)

Reps’ guidance for clients as unanswered questions about the deal mount

One sitting-pretty sector of TV that is completely unbothered

Two causes for “excitement and optimism” from the $83 billion pact

This column is for paid subscribers only. Interested in a group sub for your team or company? Click here.

For full access and to continue reading all Ankler content, paid subscribers can click here.