Netflix Users – Going, Going...

They warned Q2 subscriber losses would be bad. But available data shows it may be far worse

In my huge report card on the streaming wars last week, one number stood out:

Netflix’s churn in America doubled to 4 percent.

As others pointed out, this is still an industry-best churn rate, tied only with Disney+.

But when you’re Netflix, being best in class may not be good enough. When Netflix’s stock price eclipsed $700 dollars last November, propping up a crazy $300 billion market capitalization, it did so by not just leading its peers, but dominating them. It’s churn rate wasn’t tied with anyone — it was half that of its nearest peer. Remember when people predicted that Netflix wouldn’t just take over TV, it would be TV?

Now, having slid down NASDAQ mountain (73 percent off from its high as of today), Netflix is still in pole position but facing the existential crisis of becoming “just another streamer.” If that happens, the company likely won’t ever see such a lofty valuation again. This especially applies if Netflix starts losing subscribers.

So that’s the question: Will Netflix report another down quarter of subscriber growth when it reports on July 19th?

Netflix set a low bar for itself, forecasting a loss of 2 million global subscribers in Q2 of 2022 in its Q1 earnings call. That was one of the numbers that sent its stock tumbling (dragging entertainment stocks down with it). But at the time, I was still skeptical it would actually lose that many global subscribers, since its Q2 content slate looked so strong, from Ozark to Umbrella Academy to Stranger Things Season 4. It sounded a little bit like managing expectations so they could beat them (earning back Wall Street’s applause).

Perusing the data though, I’m worried Netflix could lose 2 million subscribers just in the domestic market of the U.S. and Canada alone.

So in this column I will dig deeper into subscriber growth, and the two numbers — churn and new customer sign-ups — that drive it.

I’ll also provide my tentative forecast on what happens to Netflix for its subscriber numbers in Q2 of 2022. I don’t usually make quarterly forecasts, but I’m making a rare exception because of the strength of data.

As a reminder, today’s analysis will focus only on the U.S. market, since it has the most robust data for it.

How to Understand Subscriber Growth

Netflix officially reports 74 million U.S. and Canadian subscribers. That means — based on historical data — that Netflix has about 65 million subscribers in the U.S. (Canada is about 10 percent of the U.S.-Canadian market).

(Fun self-serving fact: I made a bold prediction back in 2019 that Netflix would end up with around 65 to 70 million subscribers. That prediction aged very well! Pat pat.)

On a chart, growth looks like this for the last 5 years:

It looks stable over time, doesn’t it? Like Netflix added about 7.5 million new subscribers from the end of 2019 to the end of 2021, right?

WRONG! In fact, Netflix added and lost tens of millions of subscribers. To understand subscriber growth, you need these two definitions:

Acquisitions (a.k.a. new subscribers, gross paid additions, or a few other terms): The number of new people who signed up in a given time period.

Retention (a.k.a. churn, retained subscribers or a few other terms): The number of subscribers who stayed subscribed in a given time period.

Think of it like this. If a streamer started the month with 100 subscribers, and three cancelled, then it retained 97 percent of its subscribers. (Or it had a 3 percent monthly churn rate.) If it added four new subscribers as well, then it would end the month with 101 subscribers. So what looks like 1 percent growth was really a growth of 4 percent new subscribers, offset by a loss of 3 percent of current subscribers. While Netflix added 7.5 million people between 2019 and 2021, that push/pull is how it really added tens of millions but also lost tens of millions.

Got that? Because those are the two puzzle pieces we need to forecast where Netflix could report U.S. subscribers on July 19th at at the midway point of 2022.

Forecasting Netflix’s Q2 Acquisitions (Or New Subs)

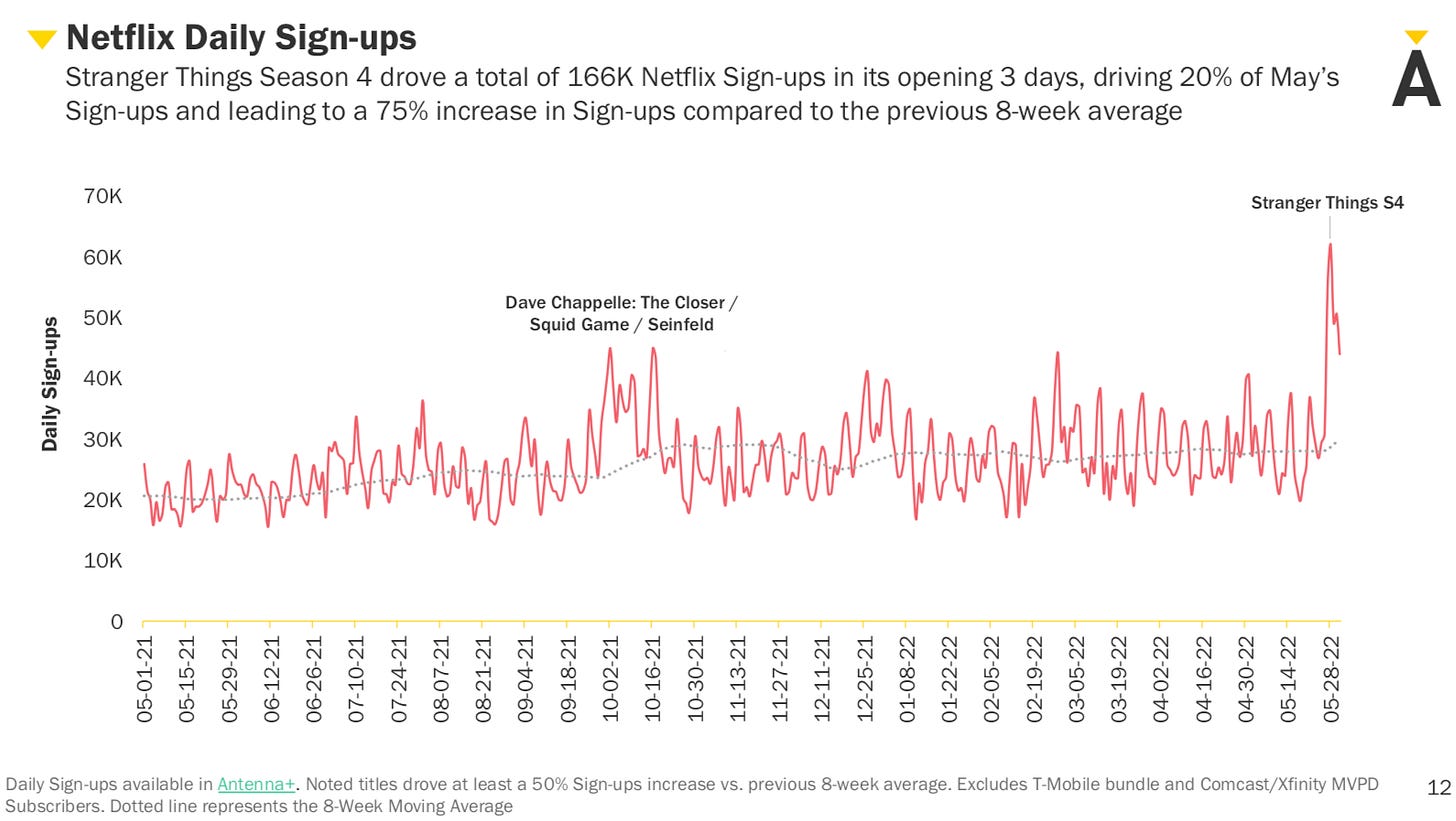

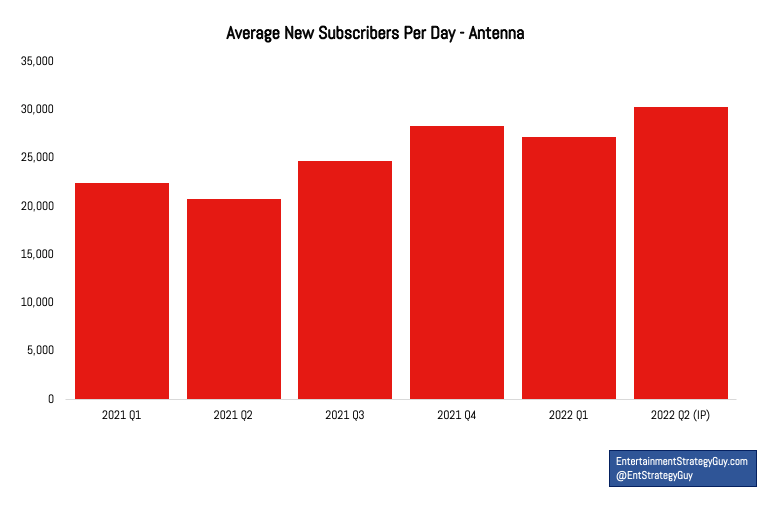

Let’s start with Antenna’s data. Antenna tracks sign-ups over time, meaning the number of new subscribers added per day. Here’s its chart:

A few takeaways from this awesome chart:

Overall, Netflix’s gross acquisitions look about the same as the first quarter of this year, when Netflix lost about 600k subscribers in the U.S. and Canada.

But! There is one difference, which is Stranger Things Season 4’s release. Look at that uptick.

Netflix’s subscriber additions in 2022, according to Antenna, actually look to be trending up in 2022 compared to 2021. Daily new subscribers by quarter, based on it’s past data:

(Caveat: Antenna does not track every subscriber in the U.S., including folks who subscribe to Netflix through their cellular provider. That said, Antenna still covers the majority of subscriptions, so it is probably a good snapshot of how customers are behaving, on average. But like any polling, it could have errors.)

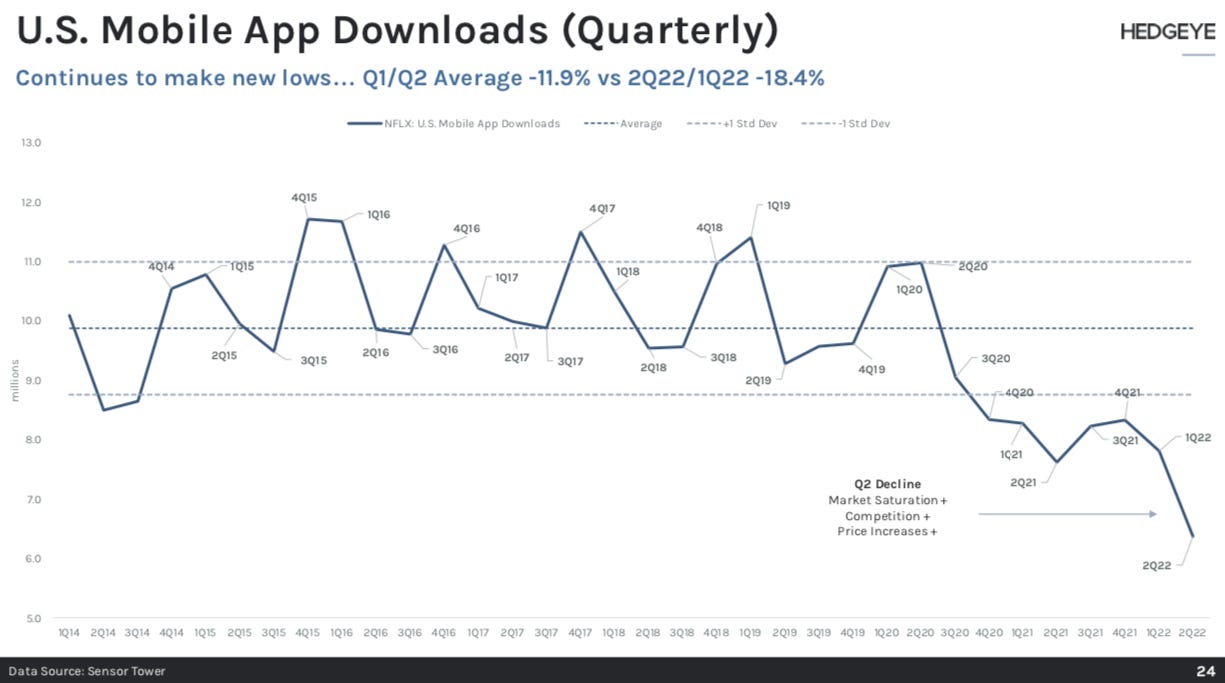

Another source I keep an eye on is mobile downloads as measured by SensorTower or Apptopia. The companies track how many people download applications onto smart devices, like phones and tablets. Hedgeye Communications — a sell side research firm — has used these downloads as a proxy for subscriber growth, and the correlation is fairly strong.

Here's Hedgeye’s summary of the Sensor Tower data through June:

These results are even worse than the Antenna data. If the correlation holds, in America at least, Netflix will have its worst quarter in terms of application downloads since at least Q4 of 2014.

(Time for caveat #2. I’m relying heavily on three data sources today: Sensor Tower, Hedgeye and Antenna. There is always a chance that, frankly, their data is wrong. Or past correlations have weakened. Think movie tracking data the last few weeks.)

Bottom line? At best, Netflix is up about 11 percent on new subscriber additions, as measured by Antenna, compared to last quarter. At worst, it will have even fewer new subscriber additions, as measured by SensorTower’s data. If it’s somewhere in between, it will be flat.

If Netflix isn’t adding a lot of new subscribers, then to keep from shrinking in the U.S. and Canada, it would need churn — the number of retained customers — to stay steady.

And the data says the opposite is happening. Keep reading…

Forecasting Netflix’s Q2 Retention (Or Churn)

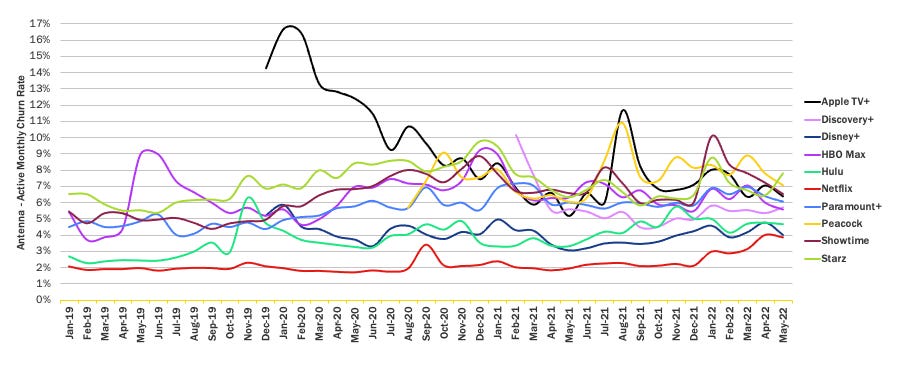

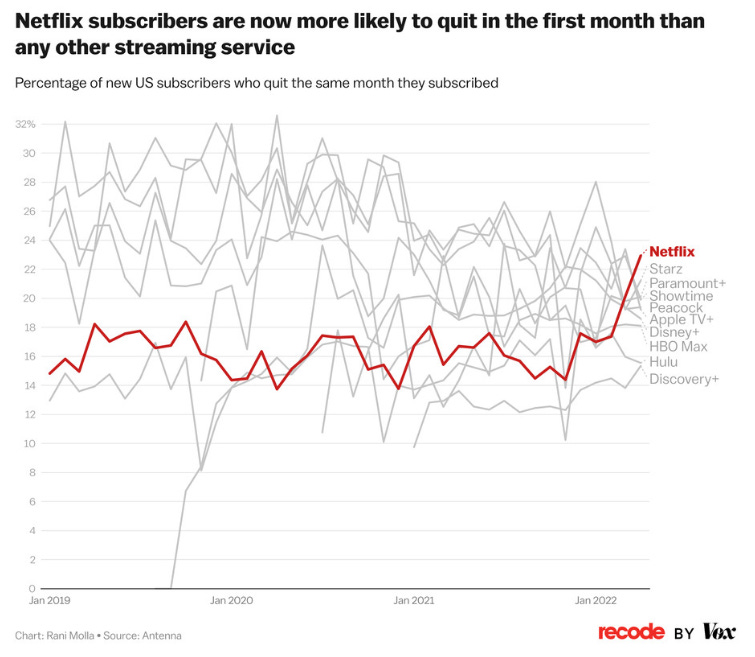

I had a chart on “churn” last week — the headline number being the doubling of Netflix’s churn. Now, let’s dive even deeper. We’ll start where we left off last week, with Antenna’s reported churn for all streamers through May:

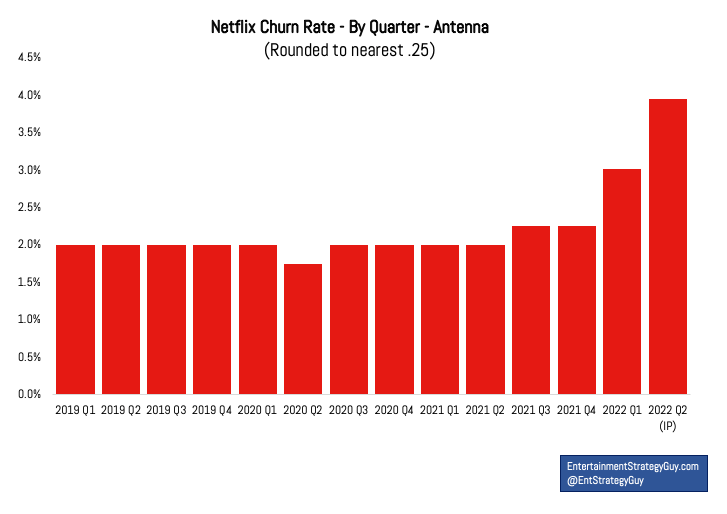

That chart is a little noisy with several streamers included, so here’s Netflix’s quarterly churn rate, rounded to the nearest 0.5 percent:

Focusing on Netflix’s churn one quarter at a time really shows how sharp the uptick in the U.S. has been this year. The only hope for Netflix is that it can materially improve in June, since Antenna has only released data through May.

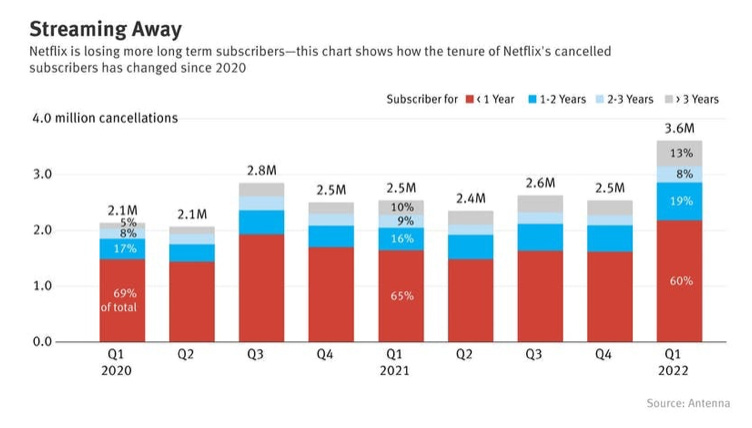

But that looks unlikely. Antenna has released a few other slices of its data, and it all shows Netflix subscribers becoming increasingly untethered from the service. For example, here’s a data analysis that was released to The Information, which shows how longterm subscribers went from being 5 percent of Netflix’s cancelled subscribers to 13 percent:

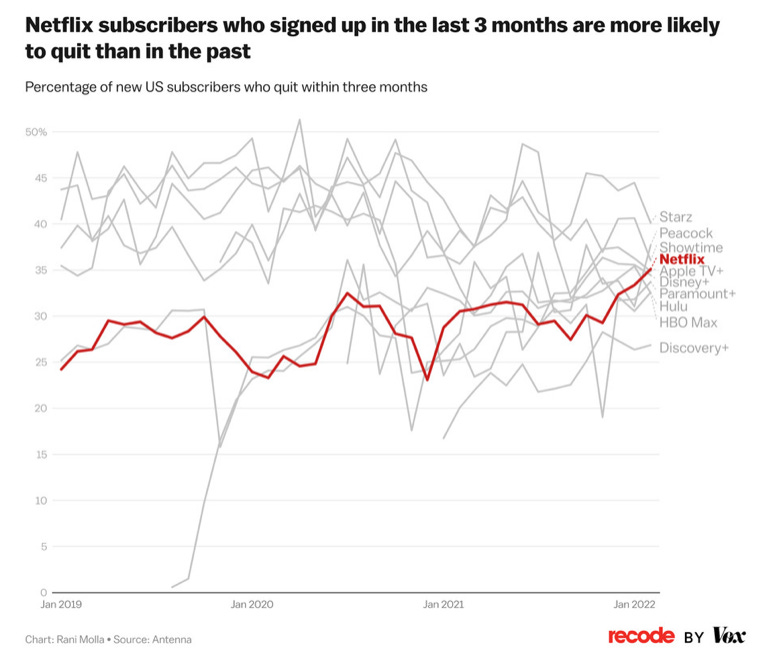

The other trend is that newer subscribers are dropping Netflix even faster than other subscribers. Here’s Antenna data that appeared in Vox/Recode last week showing the churn rate among subscribers for one and three months:

In both of these charts, the story is similar to the overall churn story, which is that Netflix used to lead the industry in retention by various cohorts, but now has seen sharp increases across the board.

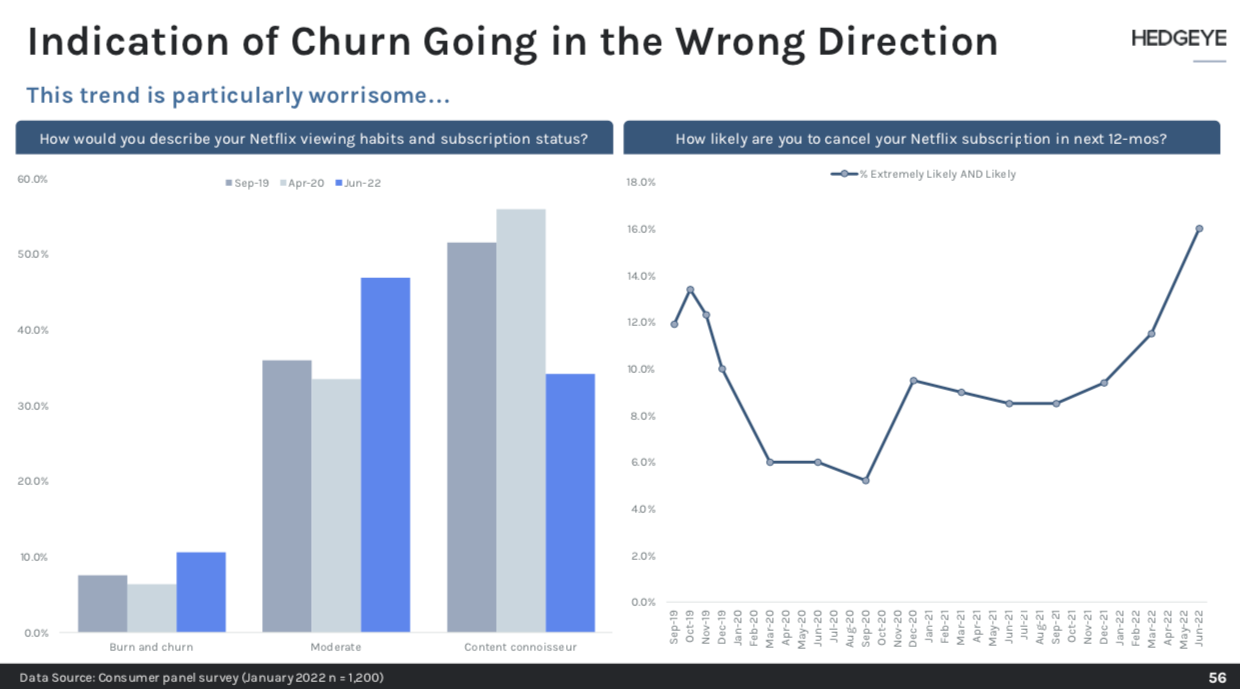

I don’t want to rely on one data source too heavily — though Antenna probably has the clearest data on churn — so here are two other data points. First, Hedgeye Communications surveys its customers over time to gauge consumer sentiment. (For the record, Andrew Freedman of Hedgeye currently has a “sell rating” on Netflix, so he is bearish on its upcoming quarter.)

Just look at Hedgeye’s survey asking about cancellation — the number who have indicated they would cancel their subscription in the next 12 months has almost tripled since its low in 2020:

The key is not to interpret this last chart literally. Customers are bad at forecasting their own behavior in practice. But as a sentiment measure, it sure seems like customers are considering cancelling much more often than the past, and that aligns with the data on churn.

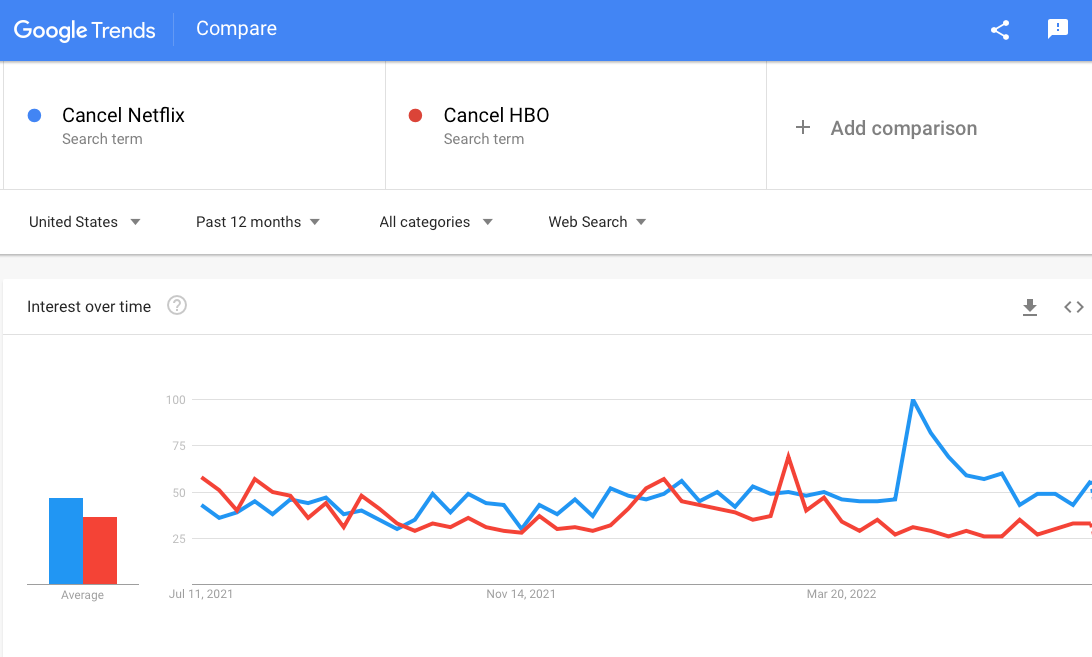

The second data point is another customer sentiment, one of my favorite measures, Google Trends. See the uptick over the last quarter? Ouch.

Not coincidentally, all these bumps in churn align with Netflix’s latest price increase in the U.S.

Forecasting Netflix’s Q2 U.S. Subscriber Losses (or Gains)

When Netflix announces its quarterly earnings on July 19th for Q2, it will reveal the usual array of subscriber numbers, including U.S. and Canadian subscribers. As a reminder, the company forecast a loss of global subscribers of 2 million in its Q1 reporting. (It doesn’t make individual territory forecasts.)

Today, we’re only focused on the North American market, and the situation seems dire. Think of it like this: all the data indicates Netflix churn increased in Q2 from an already-high first quarter. And the data around new subscribers quarter-over-quarter doesn’t look much better.

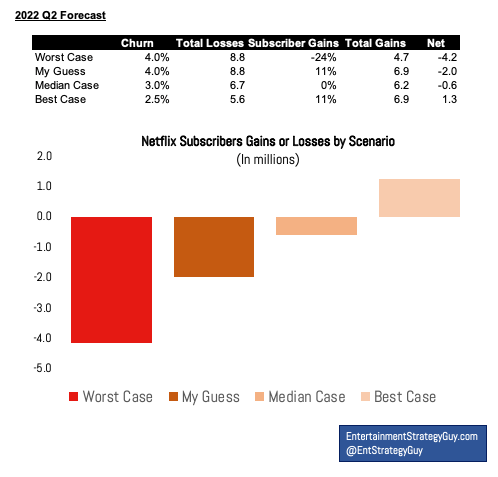

Making predictions is hard (especially about the future, as the quip goes) but with a few assumptions, I could easily come up with this:

I see a world where Netflix could lose 2 million subscribers in just the U.S. and Canada.

Here’s the math behind that.

Start with idea that Netflix had 3 percent churn in Q1.

Based on its 75 million subscribers at the end of 2021, that implies it lost 6.8 million subscribers, but added 6.2 million, netting out at a loss of 600k customers.

If we push churn up to 4 percent (remember per month) and increase new subscribers by 11 percent using Antenna’s data showing a Stranger Things boost, that means a loss of around 2 million subscribers.

Here are four scenarios for it, including a best case, worst case, median case and my gut estimate:

Call that an 80 percent confidence interval. (And its large, right? That’s the trouble with predictions.)

Let’s assume I’m right, and the churn numbers are real and Netflix does lose 2 million subscribers in just the U.S. and Canada. Maybe this is exactly what Netflix forecast — meaning the rest of the world could be flat to match its forecast — but that’s still not a great sign for the U.S. market. Even another loss of 600k subscribers would send warning signs to Wall Street about its longterm economics.

These potential subscriber losses would explain why Netflix has moved so quickly to add an advertising-supported tier. If Netflix sees this increased churn, an ad-supported version may be the only way to either add subscribers or generate additional revenue.

Time for one final caveat? I could be wrong. Way wrong. I usually avoid making quarterly forecasts because they are very, very noisy. I made an exception today because a lot of the data is pointing the same way — down — and it was worth laying out.

(If you enjoyed this data dive, check out my other writings over at my newsletter. Last week I did an even deeper dive into U.S. streaming subscribers and this week my streaming ratings report will feature HBO Max’s Nielsen viewership for the first time. Subscribe here.)

This is a free issue of The Ankler. Sign up today and don’t miss a thing.

New on The Ankler.

Today’s The Wakeup Our latest morning roundup of Hollywood and media news.

Sony: The State of Slate Every division, every decision — and a coming theme park (for real)!

Martini Shot - ‘But Mine is Different’ Rob Long on how to feel when a studio exec dismisses your pitch with “they did that” already.

A Hollywood Manifesto for the Culture Wars America is tearing itself to pieces. How do the leading manufacturers of “culture” survive?