Need Money? A Guide to Asian Investment Under Trump

China, Japan, South Korea & India have poured billions into Hollywood. Now, says an O'Melveny partner, 'We're in a little bit of a deep breath moment'

Ashley Cullins writes about agents, lawyers and dealmakers for paid subscribers every other Tuesday. She recently covered the New Rules of Film Finance; the Pixar of AI signing up stars; how Jason Blum thinks about deals; and how WME and CAA podcast agents are scoring nine-figure deals. You can reach her at ashley@theankler.com

“Right place, right time.” That’s what Legendary Entertainment CEO Josh Grode told THR last month when Legendary announced it was buying out Wanda’s remaining stake in the studio. The deal sparked speculation that it was cutting Chinese ties to become a more attractive M&A target. Others observed that if Wanda needed cash and Legendary was in a position to reclaim that stake, there was no reason not to do it.

Either way, the move looked prescient after Donald Trump won the 2024 election.

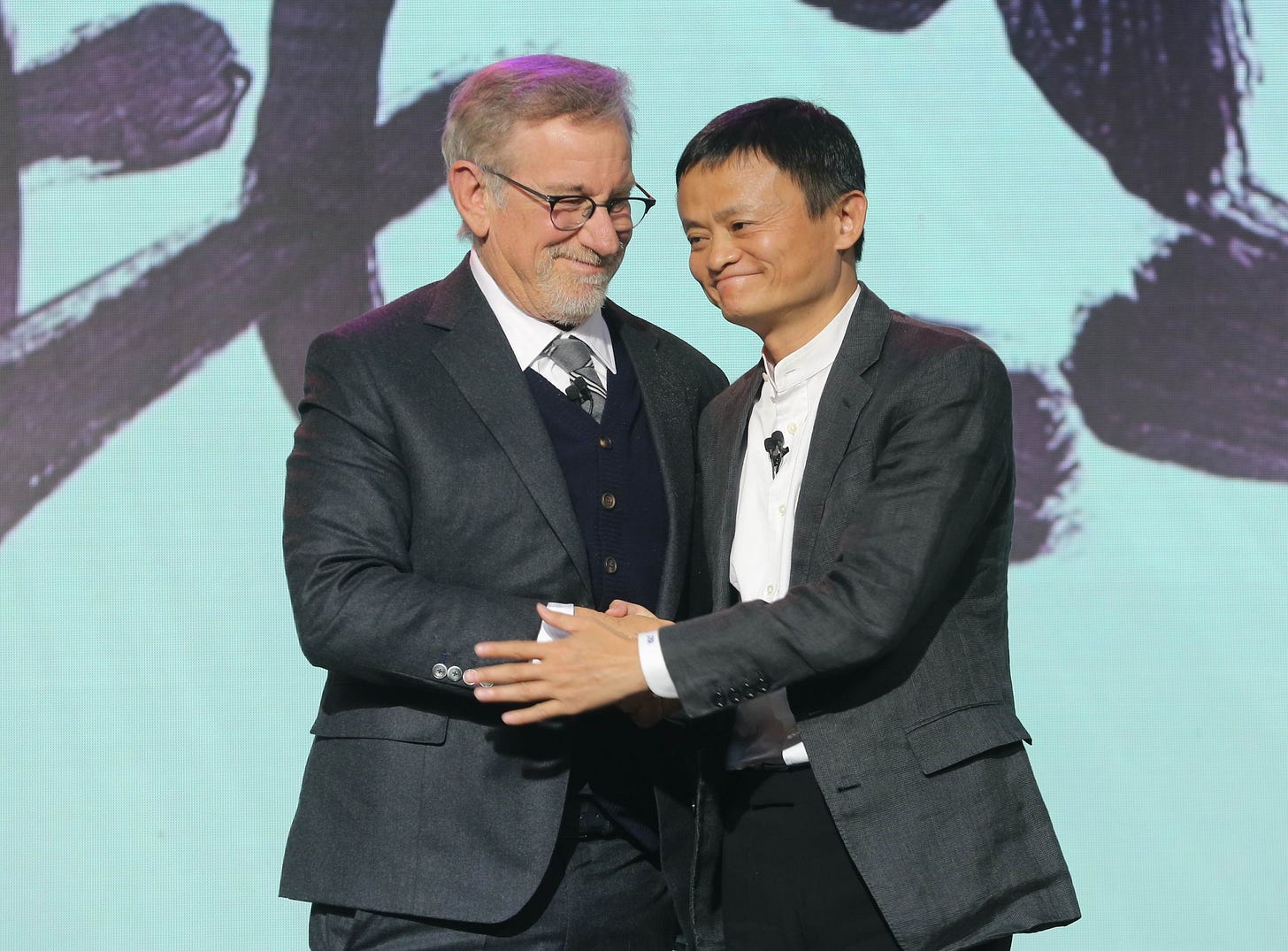

Almost 10 years ago, China poured about $5 billion into the entertainment business. Among the deals: Alibaba Pictures’ minority stake in Amblin Partners; Bona Film Group’s $235 million investment in a Fox slate; the Russo Bros.’ AGBO got $250 million in seed funding from Huayi Brothers; Perfect World put up $500 million in a deal with Universal; and, of course, Dalian Wanda paid $3.5 billion for Legendary.

Now, everyone in corporate America who does business in Asia is wondering what the Trump administration will mean for their business, with his proposed tariffs and hawkish cabinet picks stoking uncertainty. For Hollywood, the strategic landscape on the world’s most populous continent has never been more complex.

“It's not wise to think of Asia in simplistic terms,” says O’Melveny partner Lindsay Conner, who has been at the center of some of the industry’s most significant cross-Pacific deals for such clients as Chinese entertainment companies Perfect World Pictures and Huayi Brothers. “It never has been, but it’s even less useful now,” he says. “You have to think about Asia as a series of territories with different markets, different appetites for investment.”

Last month, we covered changes in Saudi investment in Hollywood. Now, “I view the Hollywood-Asia relationship as being in a period of thoughtful engagement,” Conner says.

So let’s engage. For this story, I spoke with lawyers and strategic advisors from Fieldfisher, Sheppard Mullin and Phoenicia Sports and Entertainment — and others who’ll remain nameless — about the current state of Hollywood deals across the continent (minus the Middle East): China, South Korea, Japan, India as well as pieces of Asia that might be ripe for Hollywood to consider more deeply.

In this issue, you’ll learn:

What Chinese entertainment companies are still writing big checks

Why Legendary won’t be the only Western asset Wanda might be looking to divest — and who might be in the market to buy it

How dealmakers expect Trump’s re-election to impact Hollywood-China relations

One of the subtle signs that Chinese investment is on the horizon

How South Korea’s media giants have leveraged K-content

How Japan is taking advantage of China’s overall retrenchment

The studios not named Sony currently leading the way

Whether India can still be a major market for the U.S. industry

The overlooked Asian regions that could be the next boom states

The hard truth about how the marketplace sees Hollywood studios

The news behind the news — it’s all covered in Semafor Media. Penned by Semafor's editor-in-chief and media columnist Ben Smith, Semafor Media dives into the political, cultural, and financial forces shaping global news organizations. With 20+ years of reporting experience at the helm, each issue is packed with thoughtful analysis, and lots of scoops.

China: Signs of Renewed Life?

It wasn’t that long ago that Chinese investment in Hollywood was all the rage, complete with a refrain about how companies were “going from kicking tires to writing checks” — 2015’s “Survive ‘til ‘25,” if you will.

“You had a huge wave of Chinese capital coming into the system,” remembers Stephen Saltzman, head of Fieldfisher’s international entertainment and media group. “China wanted to build its own Hollywood. There would naturally be knowhow transfer, and they were willing to pay for it. They were willing to do deals that would enable that. Then it became politically unacceptable to do this, particularly in light of a then open trade war with the U.S. By 2020, that tap really shut off.”

The tap reopened — a little — this spring.