Microdrama Boom: Why Your Next Job May Be With a 60-Second Soap

Legacy TV players wake up to a $7B opening: Stay stuck in the old system, and ‘you’re never going to make it work in this new world’

I write about TV from L.A. My latest Sellers’ Guides reveal what networks and streamers are buying now, I wrote about Gen X Hollywood’s career crisis, and I interviewed Lionsgate’s Scott Herbst about the studio’s scripted TV strategy. I’m elaine@theankler.com

Happy Monday, Series Business readers — there’s nothing like a flower sprouting in a sidewalk crack to give you a bit of hope while the rest of the city looks barren. As you could tell from my Summer Seller Guides, pitches are being bought and shows are in development. But if you talk to folks around town, there’s still a lot of handwringing over where to find growth in a shrinking TV economy.

So your ears should perk up, as mine did, when you hear a high-level TV executive talking about an emerging market that could soon require a “massive volume” of content. That’s what TelevisaUnivision head of streaming and digital Rafael Urbina says about the anticipated need to fill microdrama slates in order to satiate an audience hungry for snackable soap operas.

Yes, microdramas — that scrappy new format you first heard of a couple months ago and now can’t seem to escape. When my colleague Natalie Jarvey of Like & Subscribe and I first wrote about the boom in vertical dramas (as they’re also known) just three months ago, the medium was still somewhat of a curiosity.

Related:

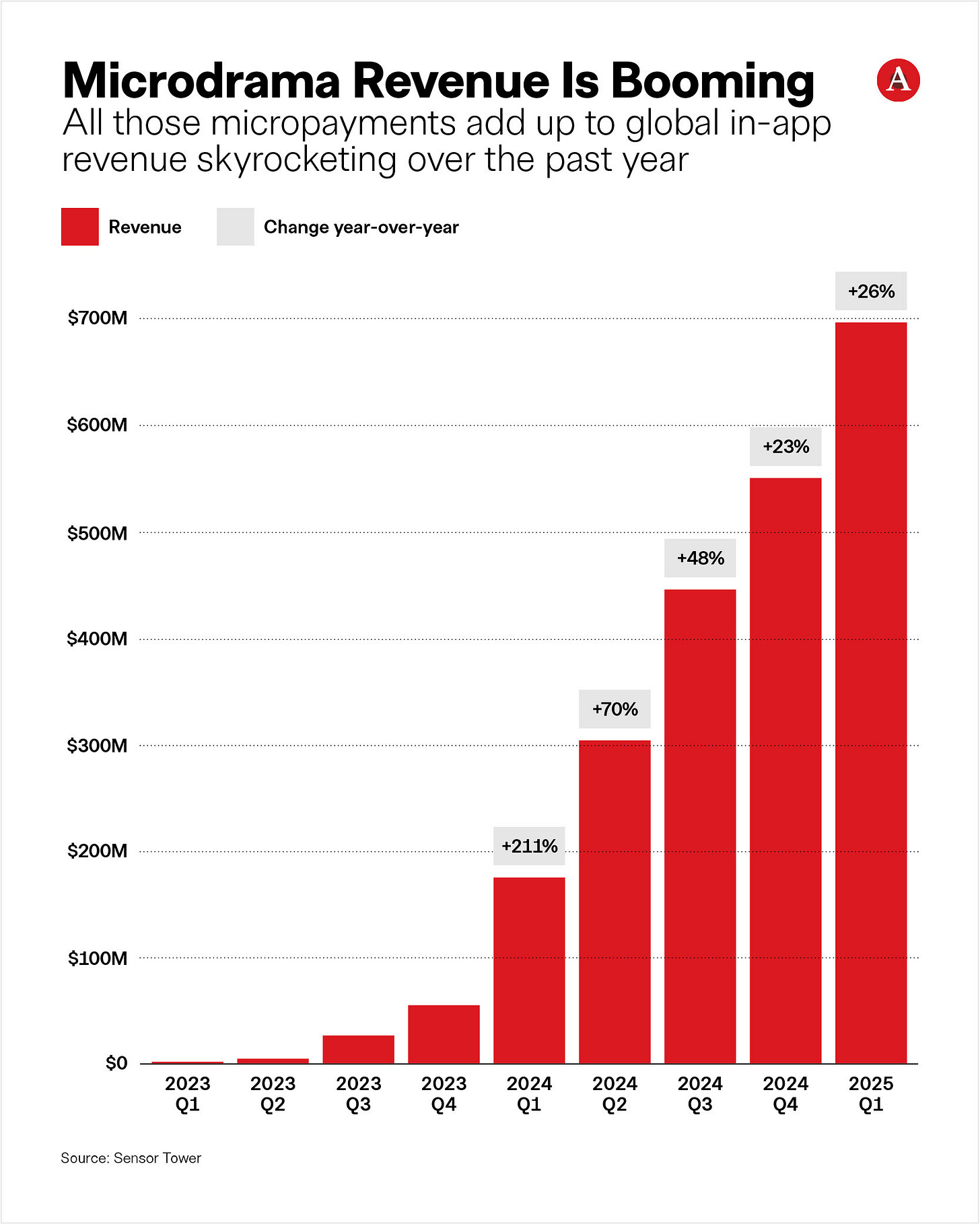

Now I can’t go to an industry cocktail party or coffee with a TV exec without someone mentioning the booming market — which, according to Sensor Tower data, has seen double- and triple-digit revenue growth in the last five quarters, to $700 million in Q1 of 2025. And that’s only looking at in-app revenue — i.e., users purchasing coins or credits to pay for content (Sensor Tower’s data is based on in-app purchase estimates from App Store and Google Play, excluding revenue from third-party Android stores). Most apps also earn advertising dollars, and the total global microdrama market for 2025 is estimated at anywhere from $7 billion to as much as $15 billion.

No wonder legacy Hollywood is starting to take serious notice. Quick on the heels of Natalie’s story last week about our set visit to Love Under Fire, a new indie vertical project from microdrama actor, writer and producer Kasey Esser, I have a second piece on this burgeoning format.

If you come from the world of traditional TV production and development, the idea of microdramas might give you pause. At their worst, they’re cheesy, thinly written and broadly acted sagas centered on handsome billionaires or sexy werewolves. They’re non-union productions. They remind you of Quibi, that ill-fated, punchline excursion into high-budget vertical content from Jeffrey Katzenberg and Meg Whitman that belly-flopped spectacularly.

But with the entry of legacy players like TelevisaUnivision and an intriguing new venture from Hollywood veterans Lloyd Braun, Jana Winograde and Susan Rovner, the microdrama space suddenly has a dose of Hollywood heft that has made it more interesting — and competitive.

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

There’s something about the way people talk about microdrama production that reminds me of the race to fill then-new streaming services from HBO Max to Apple TV+ with hours of original series ahead of launch. For instance, TelevisaUnivision’s Spanish-speaking streaming service ViX, which has 10 million subscribers globally, has been releasing new microdramas once a week since late July. As it announced at Upfronts, there are plans to roll out 40 such vertical series by the end of the year.

“Given the rate at which consumers are going through these shows, we’re going to need a lot of content,” Urbina tells me. Because of how bingeable they are (a microdrama typically has anywhere from 30 to 75 minute-long chapters, each with its own compelling cliffhanger), premiering just a few dozen new microdramas per year on a streamer won’t cut it. “If you can figure out a way to make the volume model work for you,” he says, “then I think you could find yourself having a very interesting business.”

There’s much more from Urbina and other microdrama stakeholders for you below, but first, a request as I research another very hot topic for a future column: How do you use AI at work? Do you use ChatGPT to help figure out if a script is sellable? Ask Google Gemini to help you refine a line of dialogue? Rely on AI in the edit bay? Like the idea of using AI-powered tools like Ember in animation? Tell me your feelings, whether you’re open or secretive about your AI use, and where you think the entertainment industry should land on this hot-button issue:

Fill out this Google Form to share your experiences with and ideas about working with AI.

Now, let’s get back to the very big business of microdramas. Today, Natalie and I tell you:

What’s drawing Hollywood veterans to the space — it’s not just the money

What microdramas share with linear TV in its ’80s and ’90s heyday

The top 10 apps and how fast they’ve grown in the past year

The genre Rovner, Winograde and Co. see as a rich untapped vein for the format that demands “immediate emotional impact”

Why a Wednesday and Top Gun: Maverick producer investing in the space doesn’t expect — or want — to see A-list stars in verticals anytime soon

TelevisaUnivision’s all-in investment, and the talent pipeline it’s building to meet surging demand

The good news for Hollywood workers as microdramas make it work to film in California

Where showbiz veterans can stumble in this Wild West market

This column is for paid subscribers only. Interested in a group sub for your team or company? Click here.

For full access and to continue reading all Ankler content, paid subscribers can click here.