Inside Hollywood's SBF Mad Scramble

Apple paid $5M for Michael Lewis' book, a Nanette Burstein doc is underway, and a who'll-finish-first race is afoot as the crypto con projects pile up

Michael Lewis’ next book, Going Infinite: The Rise and Fall of a New Tycoon is scheduled to come out Oct. 3 — right around the time its subject, Sam Bankman-Fried, will be heading to U.S. District Court to stand trial for allegations of wire fraud, commodities fraud, securities fraud, money laundering and related conspiracy charges. He is, of course, the former head of the cryptocurrency platform FTX that epically flamed out last year, wiping out almost $9 billion in unaccounted-for customer funds.

For an entertainment industry maybe, possibly, hopefully emerging from currently the second-longest work stoppage in its history around then, there’s a lot riding on the story of Bankman-Fried (also known by his initials, SBF). Could the sensational rise-and-fall narrative, parked in competing TV series and films around town, serve as a badly-needed get-your-engines-restarted defibrillator following the strike? Or will the crush of new projects around one man become an instant relic of a newly bygone era once characterized by pyrrhic Streaming Wars, copycat shows and unprecedented spending by a tiny pool of tech giants?

In total, there are at least eight reported Hollywood projects in the works so far on SBF — and in the last few days, I learned as well of a new one: I hear that a high profile doc from documentarian Nanette Burstein (Hillary) and Propagate, featuring exclusive inside access, has been in the works since early summer (Propagate declined comment; Burstein manager Scott Greenberg and agency CAA did not respond).

Of course, ripped-from-the-headlines film and television IP is nothing new in Hollywood, but Lewis’ latest coup — embedding himself for a year with SBF and thusly granted fly-on-the-wall access to the now 31-year-old crypto tycoon’s rise, downfall, arrest and extradition — was almost too good to be true. (He is presently being held in Brooklyn’s notorious Metropolitan Detention Center.)

After The Ankler first broke the news back in November that Lewis had been embedded, and was shopping filmed rights, an old-school Hollywood bidding war broke out for the yet-unwritten book as the story unfolded in real time. Apple ultimately landed those rights.

What hasn’t been reported is the price the Cupertino-based tech giant paid to beat out other bidders. According to several sources, $5 million dollars is what it took to take Going Infinite off the table (Apple did not respond to a request for comment).

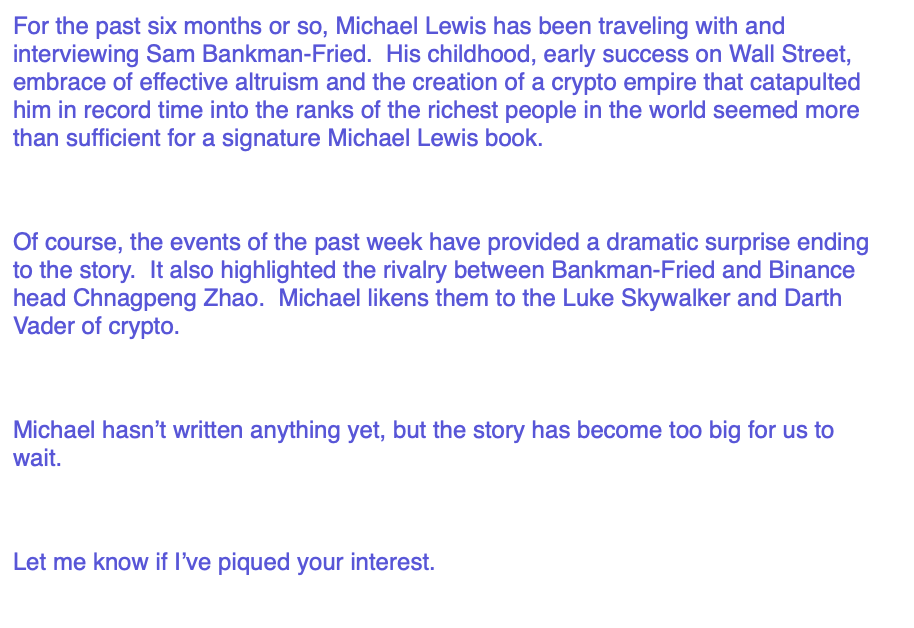

The Nov. 2022 email from Lewis’ agent to studios/streamers:

The First-to-Market Race

Five million is serious coin to shell out for a book, putting it at the near-top of filmed rights windfalls. Historical comps include the already-at-the-time bestseller The DaVinci Code ($6 million) and the Harry Potter series ($2 million for films 1-4). For an unpublished tome? Unprecedented.

When I ran the $5 million Going Infinite figure by a producer friend, he remarked: “That’s why the industry needs to be broken up. How many buyers are there who can compete on a project like that one? Three (Amazon, Apple and Netflix)? It’s crazy.” (Sellers of course, would beg to differ.) But given Lewis’ track record — Moneyball, The Big Short and The Blind Side (the recent scandal centering on football star Michael Oher’s claims that he was swindled by the family that took him in, notwithstanding) — it’s never a bad idea to bet big on him, and Going Infinite is as close to a sure thing to land on the bestseller lists as you can find. And by any measures, the SBF story is riveting — particularly when the subject has appeared so enamored of talking about what he did, both before and after (prior to being jailed), and thus providing multiple ways into available IP.

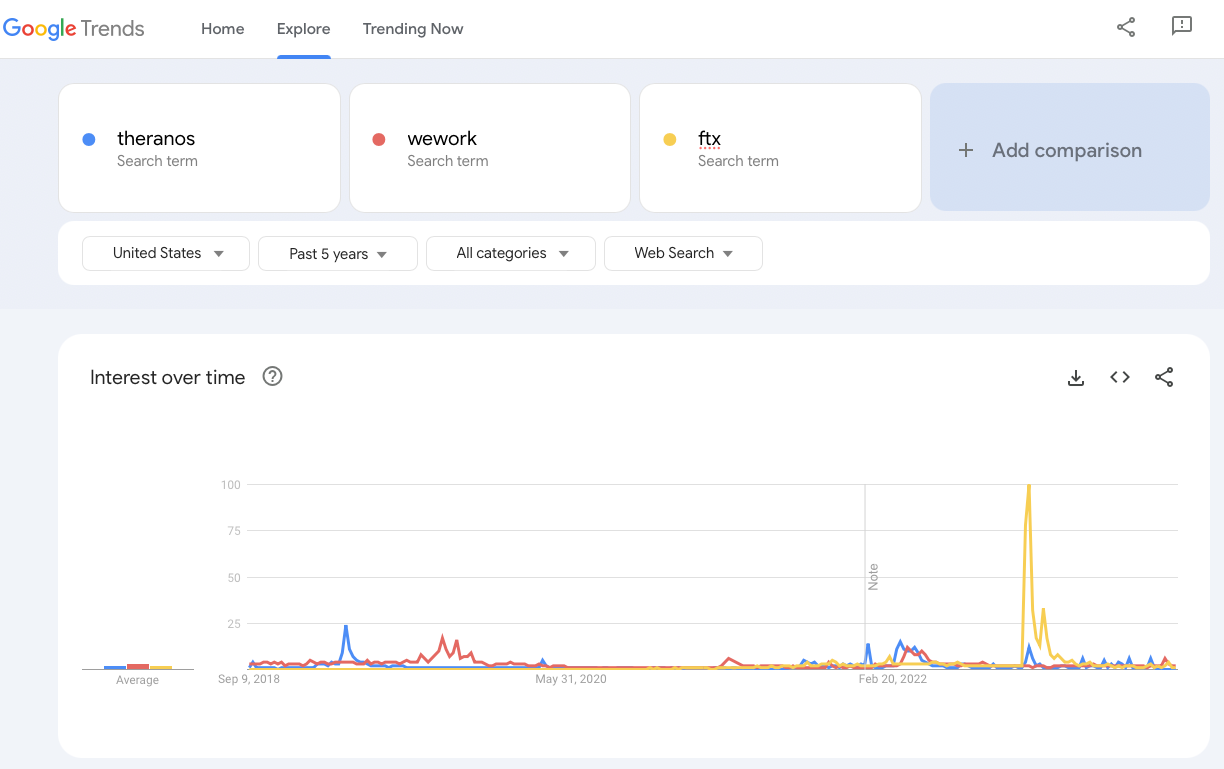

But there’s a different calculus for who gets the “win” in Hollywood on seismic stories like this. Case in point: Elizabeth Holmes. The seminal piece of IP about the billion-dollar blood-testing startup Theranos and its founder was Bad Blood: Secrets and Lies in a Silicon Valley Startup by the investigative journalist John Carreyrou. Adam McKay scooped up those rights and set Oscar-winner Jennifer Lawrence to play Holmes. But when Hulu’s The Dropout, based on an ABC News podcast, jumped ahead and picked up buzz for Amanda Seyfried’s performance as Holmes, it all but ended McKay’s efforts. Lawrence conceded in an interview with the New York Times, “I was like, ‘Yeah, we don’t need to redo that. She did it.’”

The Contenders in Wait

Prior to the strike, Hollywood was at Peak Grifter. In addition to The Dropout, there was the story surrounding Anna Delvey, Inventing Anna (Netflix), which had the sixth most-watched season one of all streamers, according to Nielsen. A month after Inventing Anna debuted, WeWork founder Adam Neumann’s story in WeCrashed (AppleTV+) aired. While WeCrashed and The Dropout received enviable reviews, neither reached Anna-heights (albeit, both on much smaller platforms). WeCrashed never made the Nielsen viewership charts, meaning it was outside the Top 10 “original” series every week it came out; The Dropout dropped outside the Top 10 in weeks five and six (where it had 3.2 and 3.9 million hours).

According to two sources, Lewis declined to provide Apple executives or any potential screenwriters access to his notes or a peek at an early draft of his book — which would be fine if not for the competing scripted projects. Director and screenwriter Scott Burns and Jonathan Glickman’s Panoramic have partnered with the New York Times’ Andrew Ross Sorkin for an SBF-related project, while the Oscar-winning writer of The Imitation Game, Graham Moore, is reportedly planning to write and direct a project based on a New York Magazine article that delved into the topic. Back in November, Amazon ordered an eight-episode limited series about the FTX scandal from Joe and Anthony Russo’s production company, AGBO, which the streamer was planning to fast-track before the writers strike. It’s safe to say every one of these projects has been delayed; and even if the strike is resolved in October, it would likely be a year before any entered the marketplace.

Meanwhile, outside of Burstein’s documentary, there are a handful of other FTX docs in the works, including projects by Vice and tech business publication The Information; another project from New York Magazine and Vox Media; a project from nonfiction studio XTR; and yet another one that Mark Wahlberg’s production company, Unrealistic Ideas, is producing in conjunction with Fortune magazine.

One litmus test for the public’s appetite for con-ecomony sagas is right around the corner. The just-commenced Toronto Film Festival will screen Dumb Money (Sony Pictures) on Sep. 8. Directed by Craig Gillespie, Dumb Money is based on the true story of the amateur day-traders who squared off against Wall Street, betting big on the losing video game chain GameStop and getting rich in the process. The film boasts an ensemble cast that includes Pete Davidson, Anthony Ramos, Seth Rogen, Shailene Woodley, America Ferrera and Nick Offerman. Dumb Money will get a limited theatrical release on Sep. 22 and will go wide a week later. There are in total at least four other projects in the works about the GameStop saga to follow.

SBF Fly in the Ointment?

Determining who ultimately has the advantage in Hollywood’s SBF sweepstakes is challenging. The last four months have (in theory) been pencils down due to the WGA strike, which complicates the starting gun on these scripted projects once the strike is ultimately resolved. One executive I spoke to observed that because no script submissions have been allowed for several months, Hollywood’s development executives, to stay busy, are being drawn to non-fiction works likes books and magazine articles, which could create even more of a glut. And of course, also advantages the documentarians (not impacted by the strikes).

Adding real-life intrigue in the race to bring SBF to the big screen are various pre-trial wranglings. Lawyers for SBF, who was sent back to jail earlier this summer after a judge revoked his bail for alleged witness tampering, are currently appealing that decision (held in Metropolitan Detention Center, Bankman-Fried, through his lawyers, has objected to his conditions, including lack of internet and vegan food). The Aug. 11 decision by U.S. District Judge Lewis Kaplan to revoke SBF’s bail was largely due to SBF’s decision to share writings by his former colleague and romantic partner Caroline Ellison with a New York Times reporter. Ellison is one of three former close associates of SBF’s who is expected to testify against him after they pled guilty to fraud. Kaplan’s ruling has since become a tussle over the First Amendment with the Times’ lawyers entering the fray by submitting an amicus brief defending SBF’s right to speak to reporters.

The debate over SBF’s First Amendment rights in the lead-up to the trial, not to mention the number of journalists involved in all of these projects, has some First Amendments experts wondering if any of these projects could get pulled into the fray. “It’s possible that an overly aggressive prosecution might pursue via subpoena to see what [SBF] said to Michael Lewis or to other journalists but that’s where the shield law would come into play. As a longtime First Amendment advocate, I’d hope that the law would prevent that sort of fishing expedition,” says Dale Cohen, director of the Documentary Film Legal Clinic at UCLA’s law school. “I don’t think this ruling that the judge made by revoking [SBF’s] bail will have any direct impact on any of the books or journalism being done on him because none of that’s subject to the court’s jurisdiction.”