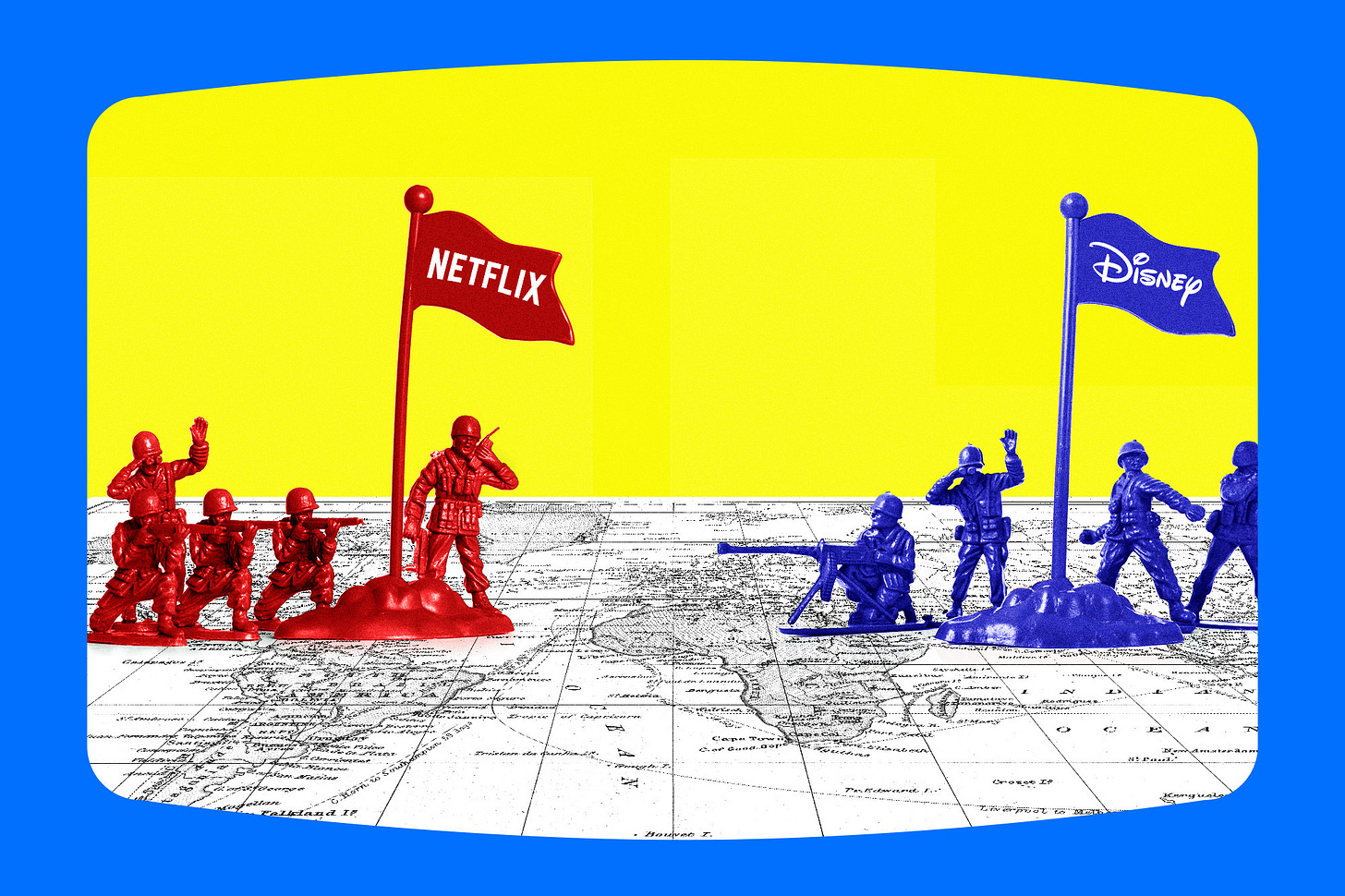

Disney vs. Netflix on Int’l: The D’Amaro–Walden Test

One company talks up global ambition. The other already built a global playbook

I cover int’l TV from London. I wrote about the global fallout of Netflix’s deal to acquire Warner Bros., how sports doc producers navigate a “brutal” landscape and the British company behind Netflix’s Adolescence. I’m manori@theankler.com

Hello from London!

Big management shakeups in Burbank don’t usually ripple out internationally right away, thanks to reporting structures that move at a glacial pace. But Disney’s latest transition is landing at a moment when global execution — not just global ambition — has become the real competitive divide in streaming.

Experiences boss and 28-year company veteran Josh D’Amaro will take the CEO reins from Bob Iger in March, while entertainment chief and talent whisperer Dana Walden has been elevated to the newly created role of president and chief creative officer. Together, they inherit a company that talks up its international ambitions — even as Netflix continues to outpace rivals by actually empowering local markets.

As my colleagues Lesley Goldberg and Sean McNulty have reported, many on the Disney lot had hoped the well-regarded Walden would get the top job, but with 72 percent of the company’s profitability deriving from D’Amaro’s division in Q4, the affable parks leader prevailed as the more Wall Street-friendly candidate.

Related:

Disney insiders overseas tell me they believe D’Amaro’s and Walden’s appointments are good news, citing a shared respect for international markets — “not just from a cash perspective,” as one longtime Disney staffer puts it.

“They have a real understanding of international,” says the source of the two execs. “Josh has always had an international portfolio, so he understands local nuances and cultures, and the importance of getting that right.”

Meanwhile, Walden has long overseen shows built to travel across multiple territories — both at Disney since 2019 and during her previous 25-year run at Fox. Moreover, as a “content person,” she comprehends the value in getting behind a global-facing local show like British drama Adolescence, which could bode well for creators and producers outside the U.S.

But right now, Disney’s sorely lacking an Adolescence-shaped hit in its international originals slate — and more concerning, a local markets strategy similar to Netflix, which now draws the majority of its viewing outside the U.S., and whose biggest non-English hits routinely rank among its most-watched global series.

And real question: Does Disney even really need a global breakout when it still leans so heavily on its U.S. IP for Disney+ overseas?

I spoke to Disney staffers, stakeholders, and a range of industry insiders to understand why the urgency for Disney to strengthen its global business is growing.

For Disney, the question isn’t whether it believes in international markets — it’s whether the company is finally willing to run like one.

Read on for intel on…

Why Disney can’t rely entirely on U.S. IP for global streaming growth

The Netflix–Warner Bros. threat — and how a combined global library would pressure Disney abroad

How local partnerships in Europe bolster Disney+’s local content offering and global portfolio

The star execs bringing “energy and pride” in EMEA now and how they could be game-changing for original series

How Netflix corporate culture and structure give it a leg up in Europe as Disney’s “hard to read” strategy slows TV development

The threat to Disney’s parks as Universal expands and Netflix innovates — and the pressure to replace D’Amaro at Experiences

This column is for paid subscribers only. Interested in a group sub for your team or company? Click here.

For full access and to continue reading all Ankler content, paid subscribers can click here.