He Sold MGM to Amazon. Now, His Hard Truths About the Coming M&A

Veteran lawyer and strategist Chris Brearton's honest insights on a changed landscape: Max and Par+'s future, sports rights and secrets of how the last big deal in Hollywood went down

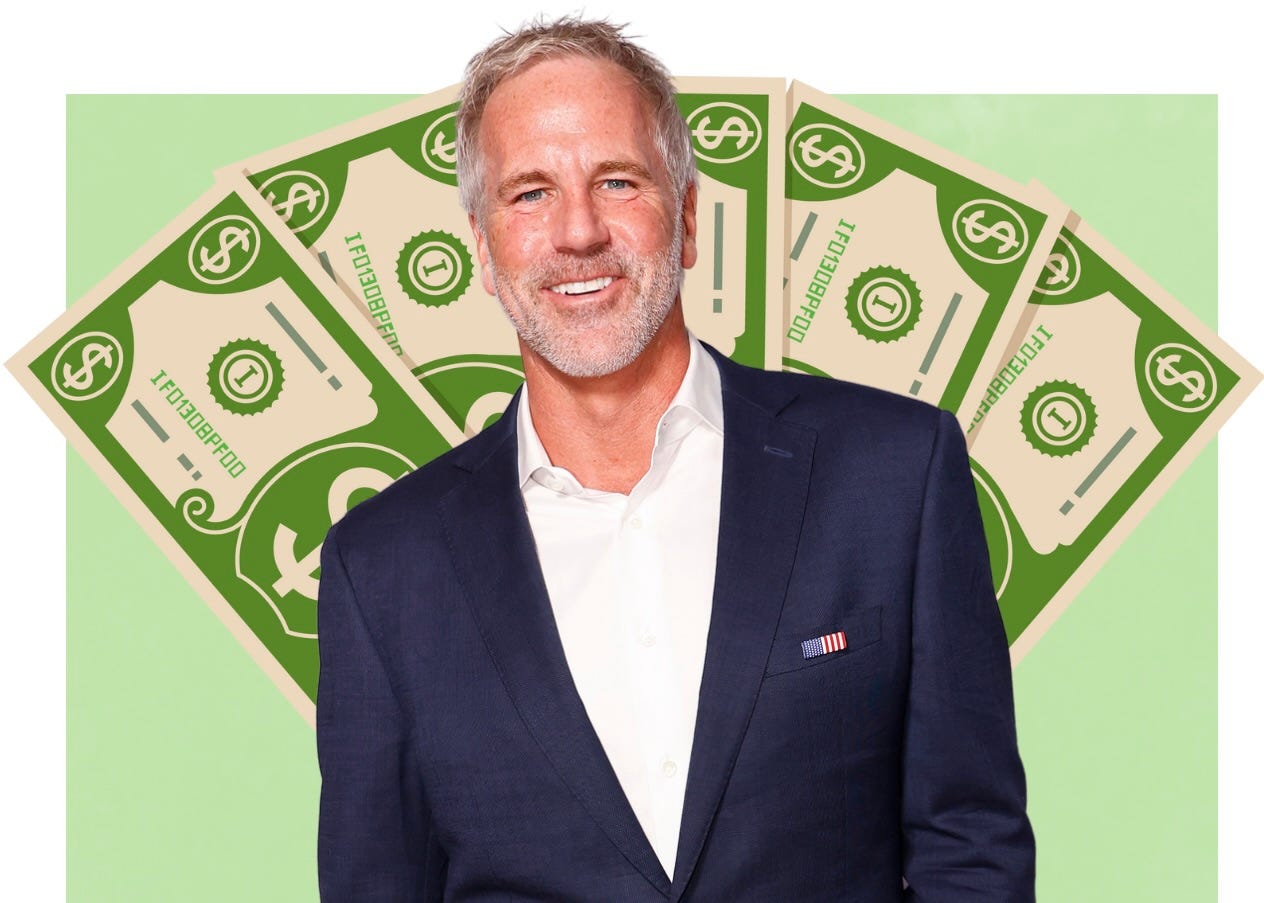

An accountant, a lawyer and a Hollywood executive walk into a bar . . . and it’s actually just one guy: Chris Brearton.

Brearton, who joined Joe Russo and Anthony Russo’s indie studio AGBO as a partner in April, has spent 30 years as an entertainment industry dealmaker from just about every angle. He didn’t set out to work in Hollywood; he fell into it while working on MGM’s business as a CPA at accounting mega-firm KPMG — a job he took because he wanted to live somewhere fun for a couple years and learn how to surf before law school. The biz had piqued his interest, though, so Brearton pursued and landed a coveted job as an entertainment lawyer at O’Melveny & Myers. He moved his sports and media practice to Latham & Watkins a decade ago, leaving in 2018 to work for one of his clients: MGM.

After leading MGM through its $8.45 billion sale to Amazon, he stuck around to help with the integration and serve as Prime Video’s VP of corporate strategy. Then he leapt to join AGBO — the Russo Brothers are also former clients and Brearton helped them capitalize on their heat after they directed 2016’s Captain America: Civil War — as it embarks on “creating cinematic IP universes from scratch.”

Brearton’s experience as a lawyer, operator, dealmaker and strategist gives him a distinct perspective on this particular moment of flux in the industry, and that’s why I wanted to talk to him now. He managed the last big studio sale before the now-pending Skydance-Paramount deal. He negotiated sports rights for eons — and now sports are the hottest commodity in media.

The contrast between the tech companies competing in media (Amazon, Netflix) and the legacy studios in some ways has never seemed more stark. As the Paramount drama unspooled over the course of the year, the latent appetite for more dealmaking only appeared to grow. Just this week at Sun Valley, WBD CEO David Zaslav told reporters that he just wants a pro-business president “so companies can consolidate and do what we need to do to be even better.”

Brearton’s view on the landscape is nuanced. He’s happy that Skydance is likely to be the new steward of Paramount, telling me, “I am particularly encouraged that Paramount remains a standalone entity, which I believe is beneficial for the industry,” especially for independent producers like himself. But when I ask him about the overall streaming market, he’s rather blunt, saying, “I don’t believe that the world necessarily needs seven general entertainment, large-scale SVOD services.”

We caught up right after he returned from a nine-day trip to Indianapolis for the Olympic trials; he’s also the chairman of USA Swimming. (Our conversation took place before the consummation of the Skydance-Paramount deal, but I checked back in with him this week to get his take.)

Our conversation has been edited for length and clarity, and in it you’ll get his analysis of:

His assessment of the strategy each Hollywood big players is pursuing

Why Amazon, Netflix and Disney are poised to win their respective games

What happened when Apple looked at MGM and its confusing content strategy

The secret moves a seller can make to prime itself for acquisition

Whether the sports rights gold rush is here to stay

The primary challenges facing independent production companies

Why Comcast probably isn’t eyeing WBD

What Skydance or any other Paramount owner will face if they want to sell its historic lot

How AGBO is trying to carve out a niche for itself