2023: The Year of Churn Baby Churn, and...

...5 more industry challenges as streaming costs accelerate all risks. And, I ask, are we the music industry 20 years ago?

I hope you had a wonderful holiday with friends and family. I know I did. So now that we’re all in a good mood…

…let’s take a deep breath and dive into what to expect this year.

Early last year, I came up with a conceit to predict every entertainment company’s Worst Case Scenario. I covered Apple TV+, Amazon, Disney, Comcast and Warner Bros. Discovery. As I built those out, I realized that a few risks weren’t just specific to each player, but rather industry wide. For example, it’s a big risk for Disney if folks keep cutting the cord, because of how much it makes from ESPN but that’s a risk for NBCUniversal and Paramount Global too. Here’s a quick list of the biggest macro risks facing both traditional entertainment companies and Big Tech:

Streaming never makes money

Theaters “die”.

The linear bundle collapses

China cracks down on Western media

Piracy grows

“Aggregeddon” as digital devices and operating systems take profits from streamers

Big Tech gets broken up/renewed antitrust sentiment

A few weeks back, I reviewed this list and realized all the risk factors but one actually became more profound last year, with 2023 continuing and in some cases set to amplify the trend lines. (The only exception being “aggregeddon” because it didn't get worse for streamers last year.)

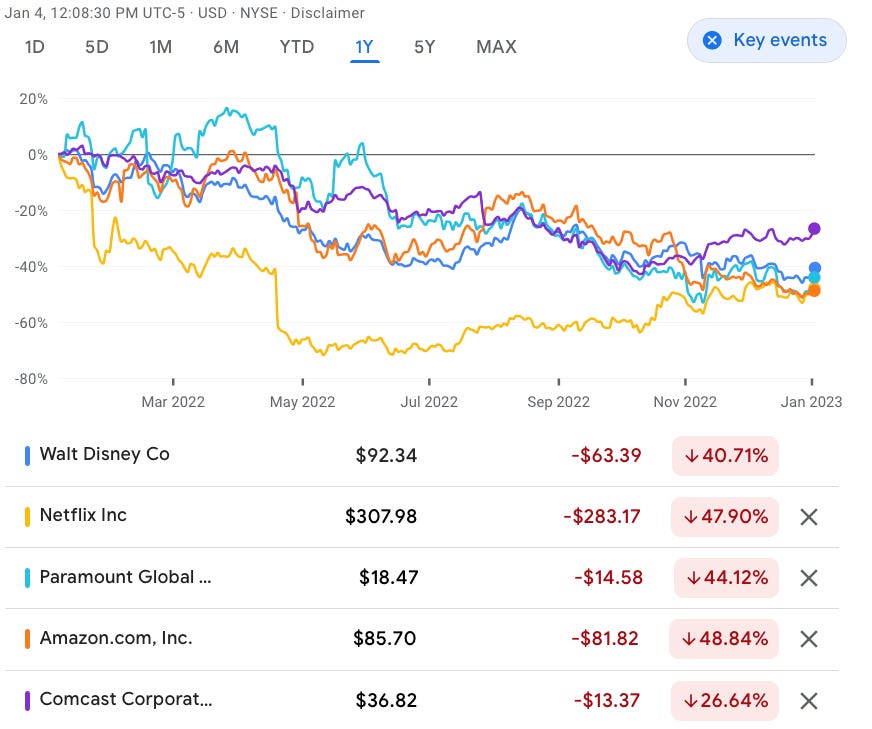

Wall Street noticed, hence the grim state of five of the biggest entertainment/tech stocks in 2022:

The good news for 2023 is that now entertainment companies can realize what went wrong. And fix it. Maybe this means bringing more films back to theaters. (Amazon and Warner Bros have already said they will.) Maybe the entertainment companies offer customers better priced bundles to decrease churn. Maybe they’ll be more cost conscious, as Warner Bros CFO Gunnar Weidenfels said just this morning. Maybe it means enacting one of Richard’s solutions from Tuesday. Or something we haven’t thought of yet. Either way, 2023 will be the year to reevaluate based on the lessons of 2022.

To kick this off, let’s look at how risk factors facing the formerly profitable entertainment industry are accelerating. In this article, I will look at how…

Streaming churn has DOUBLED and how that is increasing costs.

What we can learn from the music industry’s 20-year woes.

The linear TV train wreck is progressing.

Every macro decline can point the finger of blame at… streaming!